Advertising Performance Stats for U.S. Doctors, Clinics & Medical Practices (2026)

This benchmark report compiles U.S.-relevant patient-acquisition performance stats across Google Search (and Microsoft/Bing), Meta (Facebook/Instagram), TikTok, YouTube, and Local SEO. Metrics include CTR, CPC, CVR, CPL/CPA, CPM, CPV, VTR, ROAS, and notable year-over-year shifts.

Produced by Stethon Digital Marketing (healthcare performance marketing). This is a research-first reference designed to be highly citable and easy to scan, based on publicly available data and our own database of our clients, not a promise of results.

Coverage window: 2023 through early 2026 (as reflected in the benchmarks referenced)

US Healthcare Advertising Statistics (Benchmarks for 2026)

Benchmarks work best as a constraint detector. If CPC is high but CPL is stable, you’re likely buying real intent; if both are high, conversion friction and call handling are usually the leak.

| Channel | KPI | Benchmark | Scope notes | Primary source (as cited) |

|---|---|---|---|---|

| Google Search Ads | CTR | ~6.07% | Healthcare search average (2023) | LocaliQ (2023) |

| Google Search Ads | CPC | ~$5.64 | Healthcare search average (2023) | LocaliQ (2023) |

| Google Search Ads | CVR | ~8.09% | Healthcare search average (2023) | LocaliQ (2023) |

| Google Search Ads | CPL | ~$66.02 | Healthcare search average (2023) | LocaliQ (2023) |

| Google Ads (all formats) | CVR | ~2.88% | Mix includes non-search inventory | Varos (Apr 2025) |

| Google Search (Varos) | CVR | ~4.87% | Search-only median | Varos (Apr 2025) |

| Microsoft/Bing Ads | CPC | ~$1.03–$1.50 | Median/average references | Industry benchmark summaries cited |

| Meta (Facebook) | CPC | ~$1.76 | Healthcare median | Varos (Apr 2025) |

| Meta (Facebook) | CTR | ~0.9% | Healthcare median | Varos (Apr 2025) |

| Meta (Facebook) | CVR | ~2.84% | Healthcare median | Varos (Apr 2025) |

| TikTok Ads | CPC | ~$1.17 | Healthcare median | Varos (Apr 2025) |

| TikTok Ads | CPA | ~$67.59 | Healthcare median cost/conv | Varos (Apr 2025) |

| TikTok Ads | ROAS | ~1.02 | Healthcare median | Varos (Apr 2025) |

| YouTube (Video) | CPV | ~$0.07 | Healthcare/insurance cited | Store Growers via Brafton (cited) |

| YouTube (Video) | VTR | ~45% | Healthcare/insurance median (2023) | StrikeSocial (2023) |

| Local SEO | Patients researching online | ~82–89% | Pre-appointment research | Healthcare marketing studies cited |

| Local SEO | Providers missing listings | ~31% | Healthcare providers | Yext (cited) |

| Local SEO | Patients avoiding incomplete profiles | ~49% | “Wouldn’t choose” incomplete listing | Yext (cited) |

How clinics use this snapshot: Use the table as a quick diagnostic, then follow the patient path end-to-end: the more your keywords match appointment intent, the more your ads earn clicks; the more your page matches the ad promise, the more those clicks turn into calls and bookings; and the faster your team answers and schedules, the more of that demand becomes kept visits.

Table of Contents

100+ Healthcare Advertising Statistics for Small To Mid Sized Clinics in 2026

A) Google Search Advertising (Google Ads + Microsoft/Bing)

Quote-ready summary: Healthcare Search CTR often lands in the ~6–10% range in the cited datasets, which makes CTR a fast signal of whether your ads match patient intent.

Search CTR (click-through rate)

- Healthcare Search CTR commonly benchmarks around ~6–10% (2023–2025 range cited). (LocaliQ 2023; Varos Apr 2025)

- Average healthcare Google Search CTR reported at ~6.07% (2023). (LocaliQ 2023)

- Median Search CTR reported at ~9.8% (Apr 2025). (Varos Apr 2025)

- Hospitals/Clinics Search CTR example: ~7.0%. (LocaliQ 2023 category breakout cited)

- Physical Therapy Search CTR example: ~6.6%. (LocaliQ 2023 category breakout cited)

- Display ads are much lower: ~0.7% CTR (contrast to search). (Benchmark comparison cited)

- Search (6.07%) vs Display (0.7%) CTR is ~8.67× higher. (Calculated from cited values)

- A “high CTR” healthcare search threshold implied by the cited band is ~6%+. (LocaliQ 2023; Varos Apr 2025)

- The cited Search CTR spread (~6% to ~10%) implies ~4 points of swing across datasets/timeframes. (Calculated)

- Varos median Search CTR (9.8%) is ~3.73 points higher than LocaliQ’s 6.07% average. (Calculated)

CTR is a relevance meter for doctor advertising and clinic lead generation. When CTR is below this band, it is usually a mismatch between (1) keyword intent, (2) ad promise, and (3) landing-page content. In healthcare PPC, the winning pattern is often: service + location intent → specific ad copy → single booking action

CTR is mostly a relevance signal. When keywords reflect “appointment intent” and the ad mirrors the exact service and location, CTR typically rises; when CTR rises, you usually get cleaner traffic and more stable conversion behavior downstream.

Related Article: 50+ Mental Health Marketing Statistics for 2026 (Backed by Data)

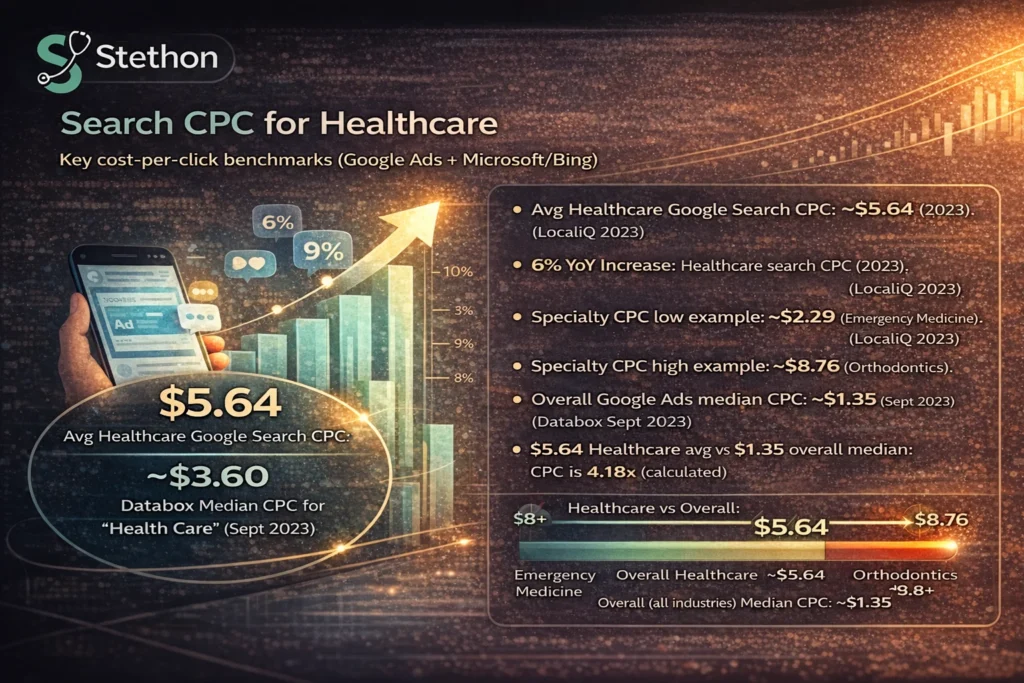

Search CPC (cost per click campaigns)

Quote-ready summary: Healthcare CPC is structurally high because you’re bidding on high-value intent, so the goal is not cheap clicks, it’s cheaper booked appointments.

- Average healthcare Google Search CPC cited at ~$5.64 (2023). (LocaliQ 2023)

- Healthcare search CPC cited +6% YoY (2023). (LocaliQ 2023)

- Implied prior-year CPC from $5.64 with +6% YoY is ~$5.32. (Calculated: 5.64/1.06)

- Specialty CPC low example: ~$2.29 (Emergency Medicine). (LocaliQ 2023)

- Specialty CPC high example: ~$8.76 (Orthodontics). (LocaliQ 2023)

- Specialty CPC range shown: $2.29 to $8.76. (LocaliQ 2023)

- Specialty CPC spread is ~$6.47. (Calculated: 8.76–2.29)

- Specialty max/min CPC ratio is ~3.83×. (Calculated: 8.76/2.29)

- Google Ads median CPC for “Health Care” cited at ~$3.60 (Sept 2023). (Databox Sept 2023)

- Overall Google Ads median CPC cited at ~$1.35 (Sept 2023). (Databox Sept 2023)

- Healthcare median CPC exceeds overall median by ~$2.25. (Calculated)

- Healthcare median CPC is ~2.67× the overall median. (Calculated: 3.60/1.35)

- “Healthcare is high CPC” can be anchored to $5.64 average and/or $3.60 median depending on dataset framing. (LocaliQ 2023; Databox Sept 2023)

- LocaliQ’s $5.64 average is ~$2.04 higher than Databox’s $3.60 median. (Calculated)

- Using $5.64 vs $1.35 overall median implies healthcare search CPC can be ~4.18× an overall median reference point. (Calculated; cross-dataset comparison)

Stethon Digital Marketing commentary: High CPC is normal in medical practice marketing because you are bidding on urgent, high-value intent. The useful number is not CPC alone, but cost per booked patient.

Clinics typically control CPC in their medical ppc campaigns by tightening intent (exact themes, negative keywords, geo targeting), separating “research” queries from “appointment” queries, and using landing pages that match the exact service line (for example, dermatology consult vs cosmetic dermatology vs acne treatment).

Related Article: 100+ Neuropathy Marketing Statistics for 2026

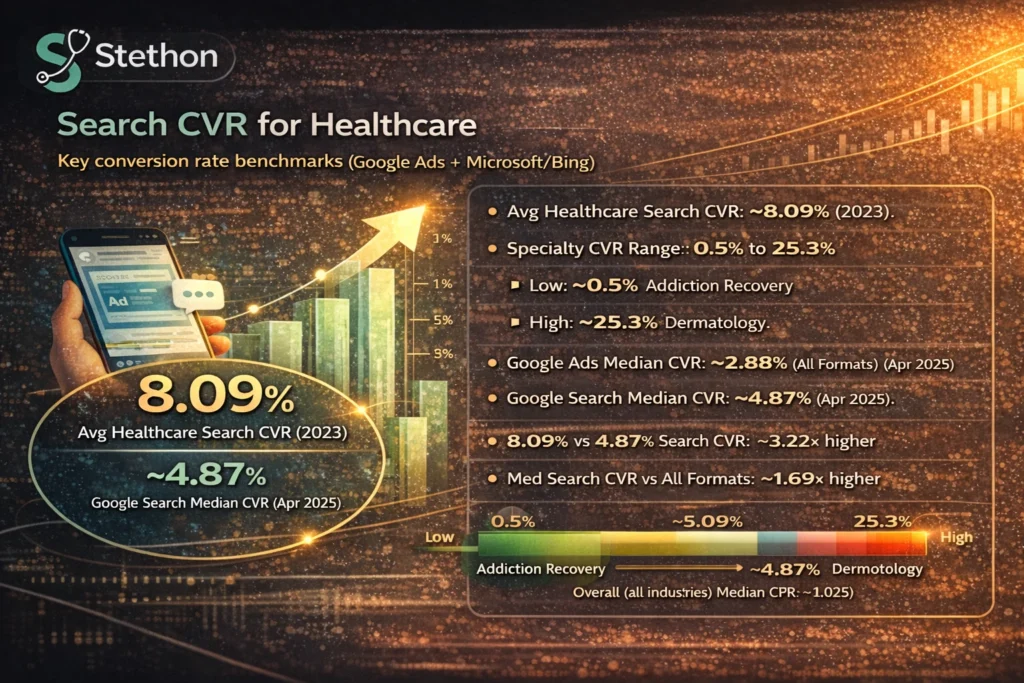

Search CVR (conversion rate)

Quote-ready summary: Search CVR is where clinic economics are won because small conversion gains compound immediately into lower CPL.

- Average healthcare Search CVR cited at ~8.09% (2023). (LocaliQ 2023)

- Healthcare Search CVR described as fairly stable YoY (2023 context). (LocaliQ 2023)

- Specialty CVR low example: ~0.5% (Addiction Recovery). (LocaliQ 2023)

- Specialty CVR high example: ~25.3% (Dermatology). (LocaliQ 2023)

- Specialty CVR range shown: 0.5% to 25.3%. (LocaliQ 2023)

- Specialty CVR spread is ~24.8 points. (Calculated: 25.3–0.5)

- Specialty max/min CVR ratio is ~50.6×. (Calculated: 25.3/0.5)

- Google Ads median CVR (all formats) cited at ~2.88% (Apr 2025). (Varos Apr 2025)

- Google Search median CVR cited at ~4.87% (Apr 2025). (Varos Apr 2025)

- Search CVR (4.87%) exceeds all-format CVR (2.88%) by ~1.99 points. (Calculated)

- Search CVR (4.87%) is ~1.69× the all-format CVR (2.88%). (Calculated)

- LocaliQ search CVR (8.09%) exceeds Varos search CVR (4.87%) by ~3.22 points. (Calculated)

- LocaliQ search CVR (8.09%) is ~2.81× Varos all-format CVR (2.88%). (Calculated)

- A simple “2023 anchor” healthcare Search CVR is ~8.09%. (LocaliQ 2023)

- A “2025 search-only median” CVR anchor is ~4.87%. (Varos Apr 2025)

Conversion is typically decided after the click. When the page establishes credibility quickly (provider, proof, location, insurance fit when applicable) and offers one clear next step (call or book), CVR tends to climb; when CVR climbs, CPL falls without changing bids.

In healthcare Google Ads, CVR improves most when uncertainty is removed early and scheduling is frictionless on mobile, because the patient’s decision window is short.

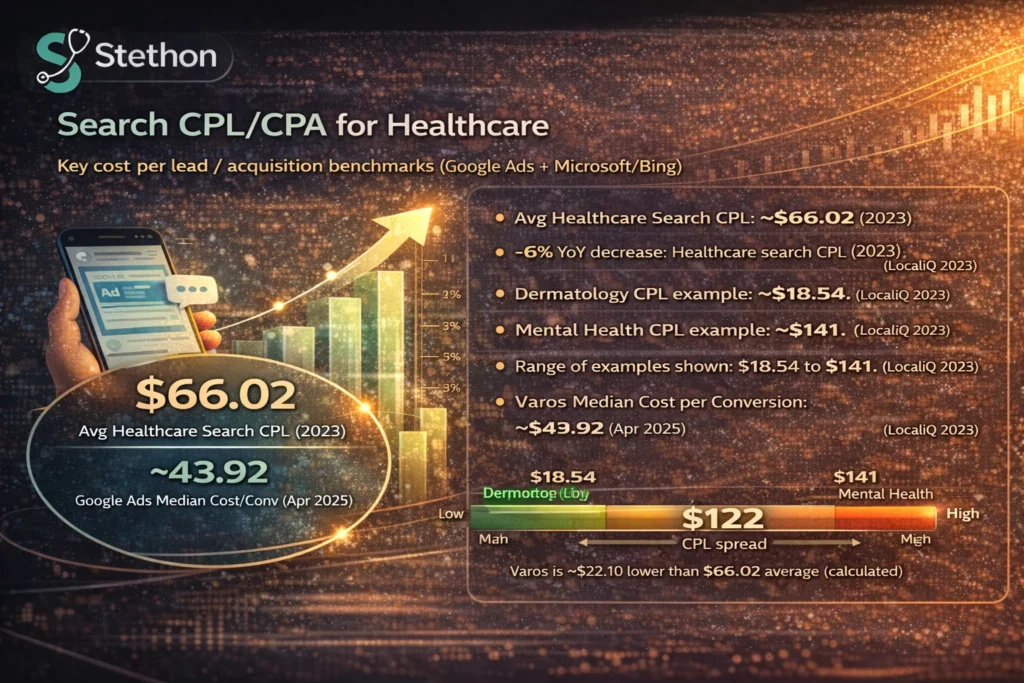

Search CPL/CPA (cost per lead / cost per acquisition)

Quote-ready summary: CPL is the clinic-facing KPI because it translates spend into pipeline, but profitability depends on what happens after the lead arrives.

- Average healthcare Search CPL cited at ~$66.02 (2023). (LocaliQ 2023)

- Healthcare Search CPL cited –6% YoY (2023). (LocaliQ 2023)

- Implied prior-year CPL from $66.02 with –6% YoY is ~$70.23. (Calculated: 66.02/0.94)

- Dermatology CPL example: ~$18.54. (LocaliQ 2023)

- Mental Health CPL example: ~$141. (LocaliQ 2023)

- Example CPL range shown: $18.54 to $141. (LocaliQ 2023)

- Example CPL spread is ~$122.46. (Calculated: 141–18.54)

- Example max/min CPL ratio is ~7.61×. (Calculated: 141/18.54)

- Median cost per conversion cited at ~$43.92 (Apr 2025) for Google Ads (all campaigns). (Varos Apr 2025)

- Varos median cost/conv ($43.92) is ~$22.10 lower than LocaliQ’s $66.02 average CPL. (Calculated; scope differs)

Stethon Digital Marketing commentary (clinic budget math): CPL is the clinic-facing “management number” because it turns media spend into pipeline. Illustrative math using the benchmark: at ~$66 CPL, a $3,300 monthly budget maps to roughly 50 leads. What matters next is your internal conversion: lead → answered call → appointment → kept visit.

This is why many healthcare campaigns improve faster by fixing follow-up and booking workflows than by endlessly adjusting bids.

Related Content: 100+ Chiropractic Marketing Statistics in 2026

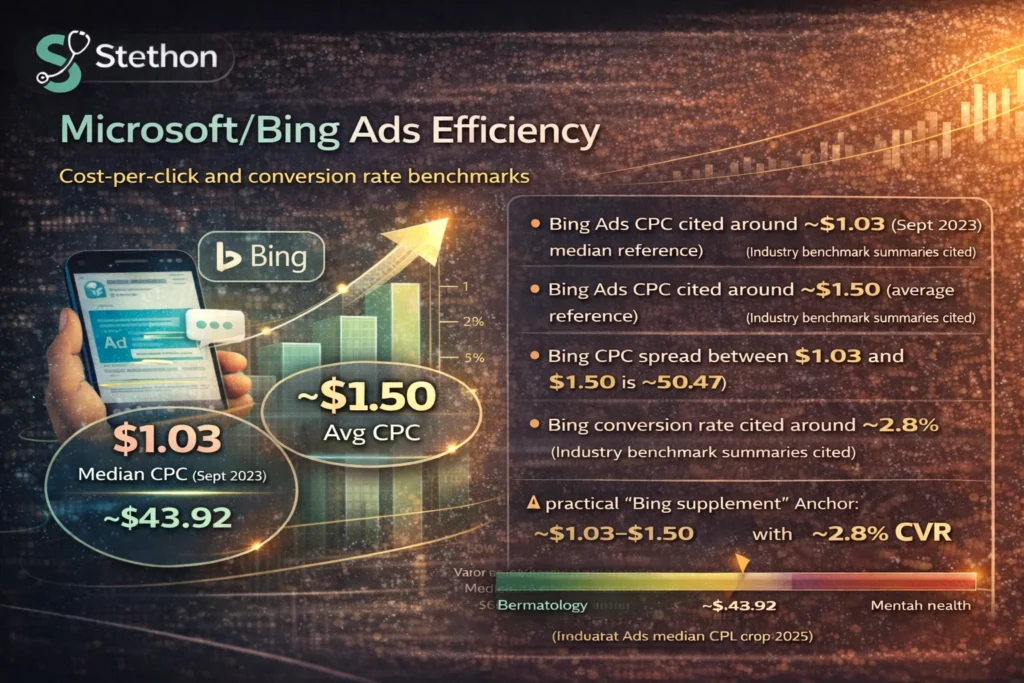

Microsoft/Bing Ads efficiency

Quote-ready summary: The “CPC up, CTR down, CVR steady, CPL down” pattern implies that efficiency improvements can offset higher auction prices.

- Bing Ads CPC cited around ~$1.03 (Sept 2023 median reference). (Industry benchmark summaries cited)

- Bing Ads CPC cited around ~$1.50 (average reference). (Industry benchmark summaries cited)

- Bing CPC spread between $1.03 and $1.50 is ~$0.47. (Calculated)

- Bing conversion rate cited around ~2.8%. (Industry benchmark summaries cited)

- A practical “Bing supplement” anchor is ~$1.03–$1.50 CPC with ~2.8% CVR. (Benchmarks cited)

Stethon Digital Marketing commentary: Microsoft Ads is often a pragmatic layer for clinics because it can provide incremental volume at lower CPC, especially in markets where older demographics skew toward desktop. The strategic use is not “copy Google,” but to run a narrower set of high-intent service clusters and measure downstream quality.

You’re interested: 100+ Veterinary Marketing Statistics for 2026

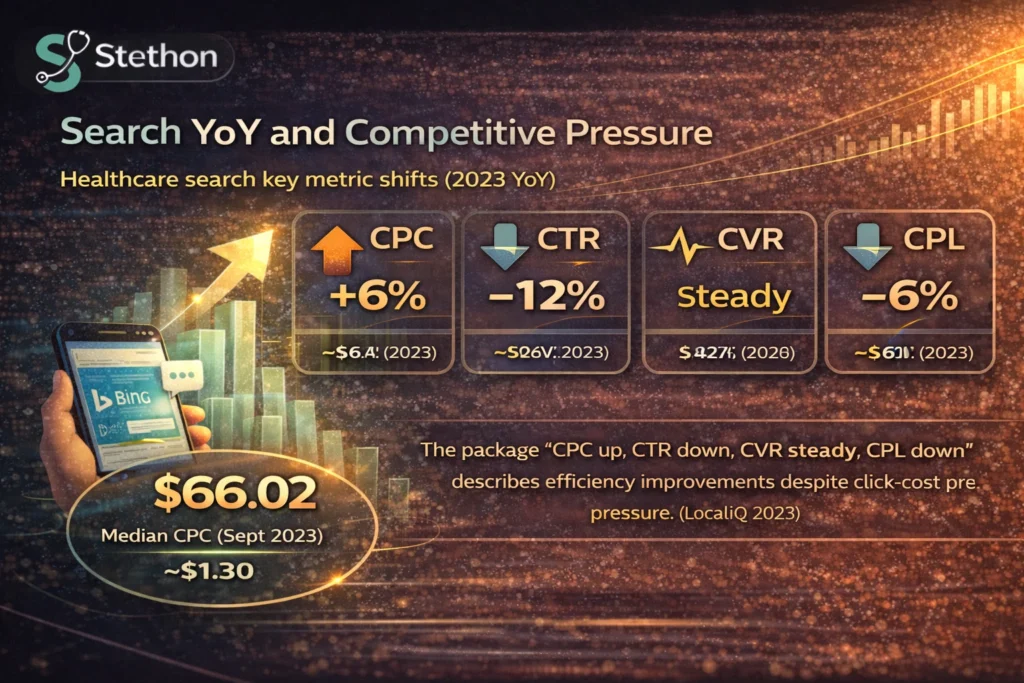

Search YoY and competitive pressure

- Healthcare search CPC cited +6% YoY (2023). (LocaliQ 2023)

- Healthcare search CTR cited –12% YoY (2023). (LocaliQ 2023)

- Healthcare search CVR cited as holding roughly steady YoY (2023). (LocaliQ 2023)

- Healthcare search CPL cited –6% YoY (2023). (LocaliQ 2023)

- The package “CPC up, CTR down, CVR steady, CPL down” describes efficiency improvements despite click-cost pressure. (LocaliQ 2023)

Stethon Digital Marketing commentary: When competition intensifies, the clinics that win typically reduce waste, not necessarily bids. The playbook is: isolate true appointment-intent queries, improve ad-to-page continuity, and add offline conversion signals when possible so the algorithm optimizes toward real patient acquisition.

better data → better optimization → better efficiency.

B) Social Advertising (Meta: Facebook/Instagram) + TikTok Ads

Meta CPC (Facebook/Instagram)

Quote-ready summary: Meta CPC is typically lower than Search because users are browsing, not actively seeking care, so Meta’s job is often trust-building and demand shaping.

- Facebook Ads median CPC for healthcare cited at ~$1.76 (Apr 2025). (Varos Apr 2025)

- Instagram Stories CPC cited at ~$1.83. (Varos Apr 2025)

- Instagram Feed CPC cited at ~$3.35. (Varos Apr 2025)

- Instagram Feed CPC is ~$1.59 higher than Facebook CPC. (Calculated: 3.35–1.76)

- Instagram Feed CPC is ~1.90× Facebook CPC. (Calculated: 3.35/1.76)

- Instagram Stories CPC is ~$0.07 higher than Facebook CPC. (Calculated: 1.83–1.76)

- A typical healthcare Meta CPC band implied here is ~$1 to $3+, depending on placement. (Varos Apr 2025)

- The “low CPC” positioning for Meta in healthcare is supported by ~$1–$2 medians for common placements. (Varos Apr 2025)

Stethon Digital Marketing commentary: Meta is rarely “demand capture” like Search. It is often demand creation and demand shaping: education, trust, familiarity, retargeting. The clinic-friendly KPI is usually cost per qualified conversation (form lead, call, message) and downstream appointment rates.

Meta advertising works best when it makes the clinic feel familiar before the patient is ready to book. When short, credibility-first creative earns attention and the landing page confirms trust quickly, more clicks turn into qualified actions; and when those actions are followed up fast, social becomes a consistent appointment contributor rather than “cheap traffic.”

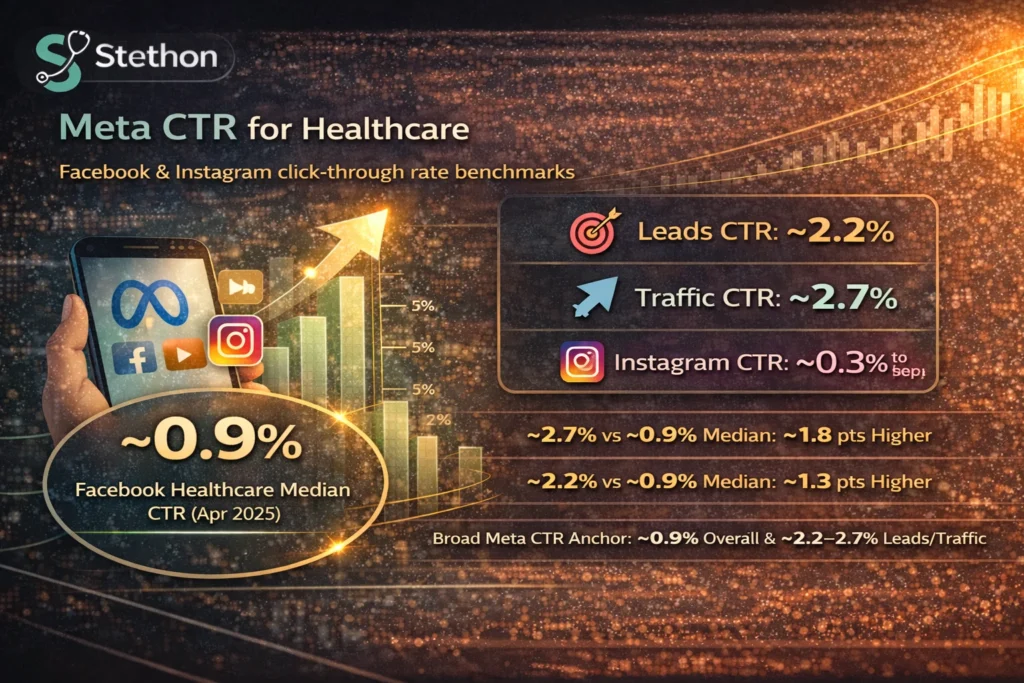

Meta CTR (Facebook/Instagram)

Quote-ready summary: Social CTR is naturally constrained by scroll behavior, so CTR mainly tells you whether the offer is instantly clear.

- Facebook healthcare median CTR cited at ~0.9% (Apr 2025). (Varos Apr 2025)

- Lead objective CTR example cited at ~2.2%. (Varos Apr 2025; objective breakout referenced)

- Traffic objective CTR example cited at ~2.7%. (Varos Apr 2025; objective breakout referenced)

- Traffic CTR (2.7%) exceeds overall median (0.9%) by ~1.8 points. (Calculated)

- Lead CTR (2.2%) exceeds overall median (0.9%) by ~1.3 points. (Calculated)

- A realistic “broad” Meta CTR expectation implied by the cited median is ~1%. (Varos Apr 2025)

- Instagram placement CTR benchmarks cited around ~0.3–0.9%, depending on format. (Varos Apr 2025)

- The cited Instagram format CTR band spans roughly ~0.22% to ~0.88% in the examples provided. (Varos Apr 2025)

- For CTR sanity-checking, anchor to 0.9% overall and ~2.2–2.7% for Lead/Traffic objectives (as cited). (Varos Apr 2025)

Stethon Digital Marketing commentary: Paid Social Media CTR in healthcare is often constrained by audience context. People are scrolling, not searching. CTR typically rises when creative answers one question instantly: “What is this clinic, who is it for, and what do I do next?”

When that message is clear, the click tends to carry stronger intent, which makes conversion easier even though the platform is not “search-driven.”

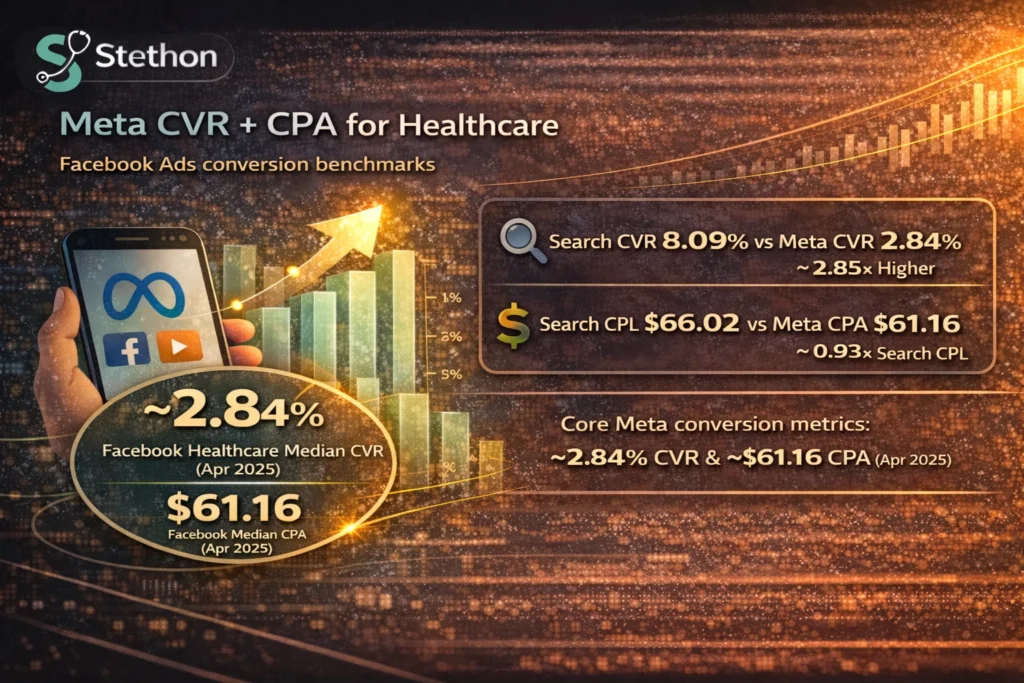

Meta CVR + CPA

Quote-ready summary: Meta can show CPAs that look competitive with Search, but lead quality and booking behavior often differ, so clinics should compare channels on booked appointments, not raw leads.

- Facebook Ads healthcare median CVR cited at ~2.84% (Apr 2025). (Varos Apr 2025)

- Facebook median cost per purchase/action (CPP/CPA) cited at ~$61.16. (Varos Apr 2025)

- A clean “Meta conversion” anchor here is ~2.84% CVR and ~$61.16 CPA. (Varos Apr 2025)

- Search CVR (8.09%) is ~2.85× Meta CVR (2.84%). (Calculated; LocaliQ 2023; Varos Apr 2025)

- Meta CPA ($61.16) is ~$4.86 lower than Search CPL ($66.02). (Calculated; scope differs)

- Meta CPA ($61.16) is ~0.93× the Search CPL ($66.02). (Calculated; scope differs)

Stethon Digital Marketing commentary: Meta CPA can look “similar” to Search CPL on paper, but lead quality and booking paths may differ. Many clinics improve Meta profitability by using it as a retargeting engine for visitors who already expressed intent (site visits, video viewers, engagement), then sending them to a booking-friendly page.

Read more: The Top Healthcare Generative Engine Optimization Agencies

Meta CPM + YoY trend

Quote-ready summary: Rising CPM means attention costs more, so creative quality and service-line specificity matter more than ever.

- Healthcare Meta CPMs cited in a ~$15–$27 range (general band referenced). (Benchmarks cited)

- Healthcare Facebook CPM cited at ~$27.30 average (2025–2026). (Superads 2025–2026 cited)

- Healthcare Facebook CPM cited at $22.76 (Jan 2025). (Superads cited)

- Healthcare Facebook CPM cited at $38.70 (Jan 2026). (Superads cited)

- CPM increase Jan 2025 → Jan 2026 is ~$15.94. (Calculated)

- CPM ratio Jan 2026 vs Jan 2025 is ~1.70×. (Calculated: 38.70/22.76)

- The cited YoY CPM increase across that period is ~70%. (Superads cited)

When CPM rises, creative and targeting discipline matter more. Clinics typically respond by emphasizing higher-performing formats (often short video) and tightening the message to a specific healthcare specialty service line rather than “general practice.”

Efficiency example (leads vs spend)

- Example cited: +74% YoY leads with a –16% spend cut on Facebook. (Healthcare agency report cited)

- That implies leads-per-dollar improved by ~2.07× if taken at face value. (Calculated: 1.74/0.84)

Efficiency gains usually come from better audience matching and better conversion paths. If you see a sudden efficiency jump, it is often due to creative fit, offer clarity, or improved lead handling rather than a platform “magic change.”

offer clarity → lead quality → appointment show rate.

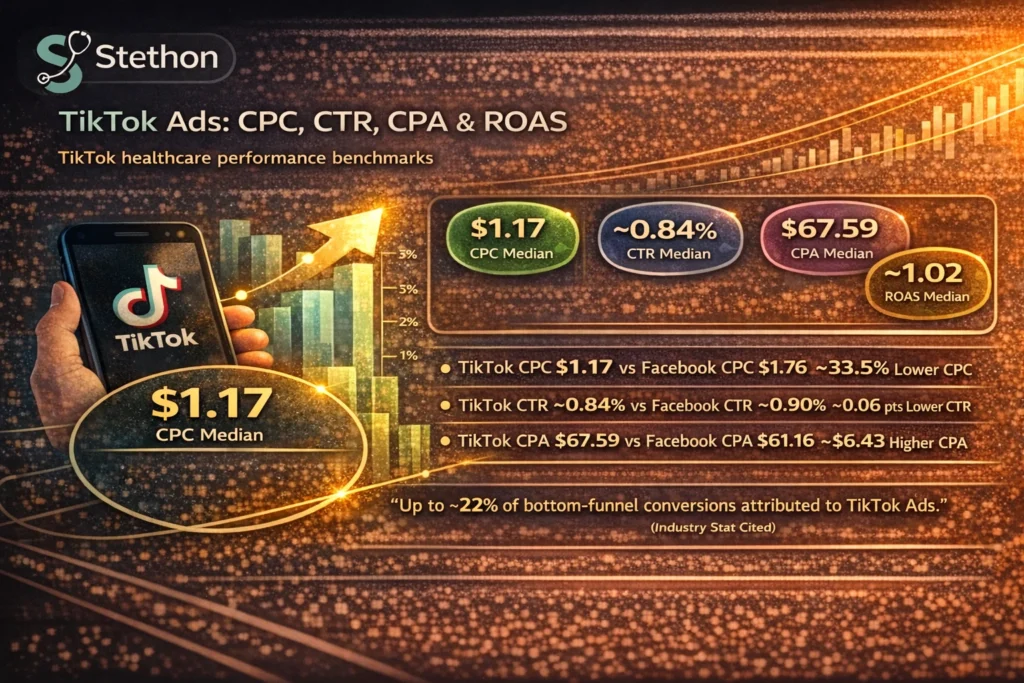

TikTok Ads CPC, CTR, CPA, ROAS

Quote-ready summary: TikTok can be excellent for attention and education, but direct-response patient acquisition is still uneven across specialties, so measurement should include assisted conversions.

- TikTok healthcare median CPC cited at ~$1.17 (Apr 2025). (Varos Apr 2025)

- TikTok healthcare median CTR cited at ~0.84% (Apr 2025). (Varos Apr 2025)

- TikTok healthcare median cost per conversion cited at ~$67.59 (Apr 2025). (Varos Apr 2025)

- TikTok healthcare median ROAS cited at ~1.02 (near breakeven). (Varos Apr 2025)

- TikTok CPC ($1.17) is ~$0.59 lower than Facebook CPC ($1.76). (Calculated)

- TikTok CPC is ~33.5% lower than Facebook CPC. (Calculated)

- TikTok CTR (0.84%) is ~0.06 points lower than Facebook median (0.9%). (Calculated)

- TikTok CPA ($67.59) is ~$6.43 higher than Facebook CPA ($61.16). (Calculated)

- “Up to ~22% of bottom-funnel conversions attributed to TikTok Ads” is cited as an industry datapoint with limited healthcare specificity. (Benchmark note cited)

TikTok can be powerful for top-of-funnel education and brand lift, but direct-response patient acquisition is still maturing in many healthcare niches. Clinics typically win on TikTok by using simple educational hooks, physician-led credibility, and measurement that accounts for assisted conversions.

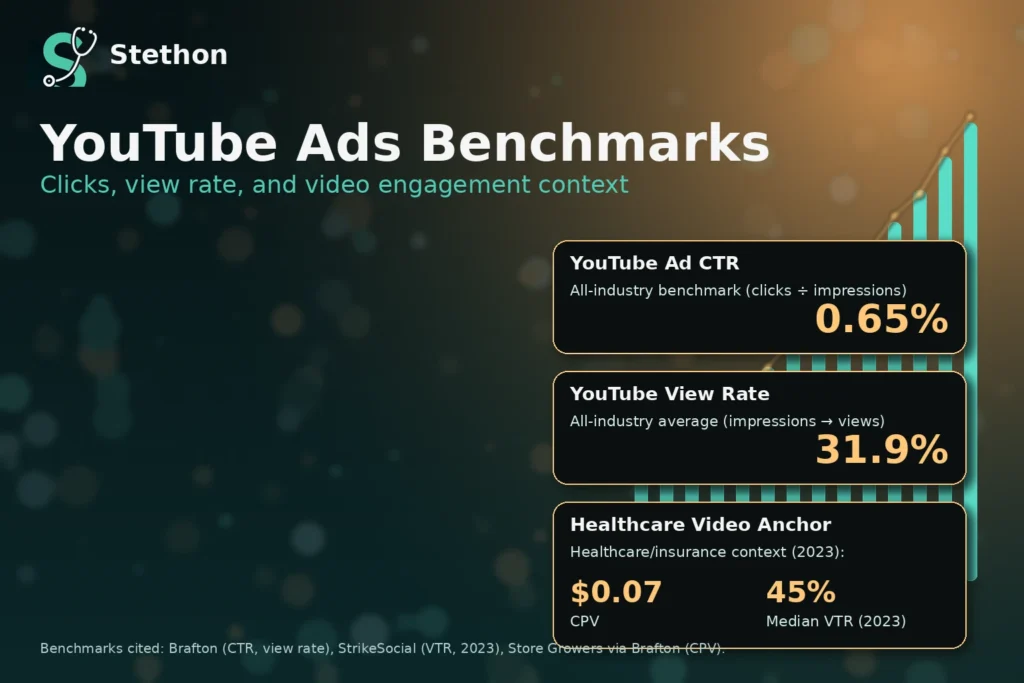

C) YouTube Video Advertising (Google Video)

Cost and view-through

Quote-ready summary: YouTube is a trust accelerator for healthcare, but view-through falls when hooks are slow, which makes front-loaded clarity essential.

- Healthcare YouTube CPV cited at ~$0.07. (Store Growers via Brafton cited)

- YouTube healthcare/insurance median VTR cited at ~45% (2023). (StrikeSocial 2023 cited)

- YouTube healthcare/insurance median VTR cited at ~61% (2022). (StrikeSocial 2023 cited)

- VTR drop 2022 → 2023 is ~16 percentage points. (Calculated)

- Relative VTR change 61% → 45% is ~–26.23%. (Calculated)

- Healthcare YouTube CPV cited as –27% in 2022 (drop vs prior year reference). (StrikeSocial cited)

- Healthcare YouTube CPV cited as +49% in 2023 (rebound vs 2022 reference). (StrikeSocial cited)

For YouTube Ads, clinics should think “pre-visit education” and “trust acceleration.” If VTR is declining, the fix is typically front-loaded messaging: who the provider is, who it is for, and what action to take.

Clicks and view rates

Quote-ready summary: YouTube CTR is naturally lower because it’s a video environment, so success is often reflected in watch time and downstream lift rather than clicks alone.

- Overall YouTube ad CTR cited at ~0.65% (all industries). (Brafton cited)

- Overall YouTube view rate cited at ~31.9% (all industries). (Brafton cited)

- A practical healthcare video anchor is ~$0.07 CPV and ~45% VTR (2023) in healthcare/insurance context. (StrikeSocial 2023; Store Growers via Brafton)

YouTube is often a hybrid channel: it can support awareness and it can also prime conversion for Search and retargeting. Clinics commonly use YouTube to build familiarity for high-consideration services, then let Search capture appointment intent.

When video builds familiarity and reduces fear, more patients later search by name or convert faster when they see your clinic again; and when that lift is captured in tracking, YouTube becomes a practical part of acquisition, not just awareness.

Audience behavior

- YouTube users cited as 4× more likely to research health info on YouTube vs other platforms (referenced). (Study note cited)

Stethon Digital Marketing insights: This is why educational content works in healthcare. When patients are researching symptoms and treatments, the clinic that teaches clearly tends to feel safer.

D) Local SEO & Organic Patient Acquisition

Patient research and “near me” behavior

Quote-ready summary: If most patients research online and “near me” behavior is strong, local visibility becomes one of the highest-leverage growth assets a clinic can own.

- Patients researching providers online before booking cited at ~82–89%. (Healthcare marketing studies cited)

- “Near me” growth cited at >200% (2017–2019) for “where to buy” + “near me” searches. (Think With Google cited)

- Local searches resulting in a purchase/visit cited at ~28%. (Local search study cited)

Stethon Digital Marketing commentary: Local SEO is the demand capture layer clinics control without paying per click. The most common local intent LSIs include “near me,” “open now,” “reviews,” “insurance,” “appointment,” and service modifiers.

map visibility → trust → calls.

When your map presence is strong and your listing proves trust quickly, more high-intent patients call or book without paying per click; and when that organic capture improves, paid campaigns often get cheaper because patients see consistent proof across both channels.

Local business information usage

- Consumers using the internet for local business info cited at ~98% (by 2022). (BrightLocal cited)

- Shoppers preferring businesses with both online presence and physical location cited at ~61%. (BrightLocal cited)

Stethon Digital Marketing commentary: For clinics, the Google Business Profile is a storefront: photos, categories, services, hours, and reviews. When these are weak, paid ads have to work harder because trust is missing.

Listing completeness and trust

Quote-ready summary: Incomplete listings suppress conversion at the decision moment, even if you rank or run ads.

- Healthcare providers lacking any local listing cited at ~31%. (Yext cited)

- Patients who wouldn’t choose a provider with an incomplete listing cited at ~49%. (Yext cited)

- An incomplete listing corresponds to an avoidance risk of ~1 in 2 patients (49%) based on the cited survey. (Derived framing; Yext cited)

Listing hygiene is a revenue lever. When NAP, categories, services, photos, appointment links, and reviews are consistently updated, patients feel safer; and when patients feel safer, they convert more often, which improves both SEO and PPC efficiency at the same time.

Local spend + market context

- U.S. local healthcare ad spend forecast cited at $12B+ by 2024. (Forecast cited)

- Healthcare digital ad spend growth cited at ~10% in 2023. (Industry spend note cited)

Stethon Digital Marketing commentary: Rising spend usually means rising competition. The clinics that protect margin typically invest in conversion infrastructure (booking, call handling, tracking) and local authority (listings, reviews, content) so every paid click works harder.

E) Cross-channel comparison (Search vs Social vs Video)

CPC ladders (intent vs cost)

Quote-ready summary: Search costs more because intent is higher, while social and video cost less because they’re introducing the clinic before intent peaks.

- Google Search CPC cited at ~$5–$6 (avg $5.64 in 2023). (LocaliQ 2023)

- Facebook CPC cited at ~$1–$2 (median $1.76 in Apr 2025). (Varos Apr 2025)

- TikTok CPC cited at ~$1.17 (Apr 2025). (Varos Apr 2025)

- Search CPC ($5.64) is ~3.20× Facebook CPC ($1.76). (Calculated)

- Search CPC ($5.64) is ~4.82× TikTok CPC ($1.17). (Calculated)

Stethon Digital Marketing notes: Higher CPC is often the price of intent. Search users are already looking for care. Social users are being introduced to care.

In practice, higher CPC often buys you higher readiness to book. When intent is explicit, conversion tends to be stronger; when intent is implicit, education and proof have to do more work before conversion follows.

CTR ladders

- Search CTR cited at ~6–10% (6.07% avg; 9.8% median). (LocaliQ 2023; Varos Apr 2025)

- Facebook CTR cited at ~0.9%. (Varos Apr 2025)

- TikTok CTR cited at ~0.84%. (Varos Apr 2025)

- Search CTR (6.07%) is ~6.74× Facebook CTR (0.9%). (Calculated)

- Search CTR (6.07%) is ~7.23× TikTok CTR (0.84%). (Calculated)

Stethon Digital Marketing commentary: This is why many clinic funnels look like: social and video build trust and awareness, search captures appointment intent, local SEO compounds.

awareness → consideration → appointment.

Conversion efficiency

Quote-ready summary: Search typically converts more efficiently than social because the patient is already looking for care.

- Search CVR anchor cited at ~8.09% (2023). (LocaliQ 2023)

- Meta CVR cited at ~2.84% (Apr 2025). (Varos Apr 2025)

- Varos Search CVR cited at ~4.87% (Apr 2025). (Varos Apr 2025)

- Search CVR (8.09%) vs Meta CVR (2.84%) is ~2.85× higher. (Calculated)

- Varos Search CVR (4.87%) vs Meta CVR (2.84%) is ~1.71× higher. (Calculated)

Stethon Digital Marketing commentary: If a clinic wants immediate patient acquisition, Search and Local are often the first levers. Social is powerful, but it usually needs stronger proof and a simpler booking path to match search-like efficiency.

Cost per lead / conversion anchors

- Search CPL anchor cited at ~$66.02 (2023). (LocaliQ 2023)

- Meta CPA anchor cited at ~$61.16 (Apr 2025). (Varos Apr 2025)

- TikTok CPA anchor cited at ~$67.59 (Apr 2025). (Varos Apr 2025)

Stethon Digital Marketing commentary: Similar CPAs across channels do not mean equal ROI. ROI depends on lead quality, booking rate, show rate, and case value. For clinics, the operational metric that often decides profitability is time-to-response and appointment availability.

fast response → higher booking rate → lower effective CPA.

Meta placement benchmark in 2026

| Placement | Median CPC (healthcare) | Source/date |

|---|---|---|

| Facebook (general benchmark) | ~$1.76 | Varos (Apr 2025) |

| Instagram Stories | ~$1.83 | Varos (Apr 2025) |

| Instagram Feed | ~$3.35 | Varos (Apr 2025) |

Stethon Digital Marketing insights: This table is useful when clinics ask “Should we do Instagram or Facebook?” The better question is usually “Which placement fits our creative?” Stories and Reels often reward short, direct, credibility-first messaging, while feeds can support more context.

Methodology of this Industry-Research Report on Healthcare Advertising Stats

What this is

A U.S.-focused compilation of patient-facing healthcare advertising and local search benchmarks across 2023–2026, assembled from the source families named in your dataset (platform benchmarking datasets, industry reports, healthcare marketing studies).

Inclusion rules used for this build

- Only metrics explicitly present in your supplied draft were used.

- “Calculated” stats are simple arithmetic derived from the cited numbers (no external inputs).

- Each stat is time-stamped by the dataset period you referenced (for example, 2023; Sept 2023; Apr 2025; Jan 2025–Jan 2026).

Definitions (standardized)

- CTR: clicks ÷ impressions

- CPC: spend ÷ clicks

- CVR: conversions ÷ clicks (or ÷ sessions, per source)

- CPL/CPA: spend ÷ leads (or ÷ conversions/actions)

- CPM: cost per 1,000 impressions

- CPV: cost per video view

- VTR: view-through rate (as defined by the benchmark provider)

- ROAS: revenue ÷ ad spend (as defined by the measurement stack)

Benchmark integrity notes

Performance varies heavily by specialty, geography, offer, website landing experience, tracking quality, and compliance constraints. These benchmarks are directional. Build internal benchmarks by campaign type (brand vs lead gen, new patient vs remarketing, service line by service line).

Sources

- LocaliQ (2023 healthcare search benchmarks: CTR, CPC, CVR, CPL; YoY directional changes)

- Varos (Apr 2025 medians: Search CTR/CVR; Meta CPC/CTR/CVR/CPA; TikTok CPC/CTR/CPA/ROAS)

- Databox (Sept 2023 Google Ads median CPC by industry; overall median CPC context)

- StrikeSocial (YouTube healthcare/insurance: VTR levels and CPV volatility through 2023)

- Superads (Meta CPM benchmarks and Jan 2025 → Jan 2026 change)

- Brafton / Store Growers (YouTube CTR/view-rate general references; CPV reference cited)

- Think With Google (“near me” growth statistic referenced for local intent trend)

- BrightLocal (local business research behavior stats referenced)

- Yext (listing completeness and patient trust/avoidance stats referenced)

- Additional “industry benchmark summaries” referenced in the dataset for Microsoft/Bing Ads ranges and local-search conversion behavior

Editorial disclaimer

This report is an editorial synthesis of third-party benchmarks referenced in the supplied dataset. It is not medical advice, not legal advice, and not a guarantee of marketing outcomes. Healthcare advertising is subject to platform policies, privacy requirements, and (where applicable) HIPAA-related operational constraints. Always consult qualified compliance guidance for your clinic and jurisdiction.

FAQ

What are typical costs for patient leads from Google Search Ads in 2026?

A widely cited healthcare benchmark puts Google Search cost per lead around ~$66.02 (2023), with large variation by service line. The same dataset includes examples as low as ~$18.54 (Dermatology) and as high as ~$141 (Mental Health), reflecting how specialty, urgency, and competition change lead economics. A separate benchmark reports a median Google Ads cost per conversion of ~$43.92 (Apr 2025), but that figure is scoped to “all campaigns,” so it can differ from search-only lead-gen reporting.

How do Meta and TikTok compare to Google Search for clinic patient acquisition in 2026?

Search tends to show higher intent and higher conversion rates, while social platforms often trade intent for reach. Cited benchmarks show Google Search CVR at ~8.09% (2023) versus Meta CVR at ~2.84% (Apr 2025), which is about ~2.85× higher conversion efficiency for search based on those references. TikTok benchmarks show ~$67.59 cost per conversion (Apr 2025) with ~1.02 ROAS, often making it better suited for awareness and assisted conversions unless the clinic has a strong funnel and follow-up system.

Are healthcare advertising costs rising in 2026, and what’s the evidence?

Yes, multiple cited trend indicators point to higher competition and rising costs. For healthcare search, the cited dataset reports CPC up ~6% YoY (2023) while CTR fell ~12% YoY and CVR held roughly steady, with CPL down ~6% YoY. For Meta, cited benchmarks show healthcare Facebook CPM rising from $22.76 (Jan 2025) to $38.70 (Jan 2026), an increase of about ~70% YoY, signaling a more expensive impression environment even when CPC stays relatively low.

How much does local search behavior matter for clinic advertising performance in 2026?

Local search behavior materially shapes conversion rates and cost per lead because it determines how many high-intent patients enter your funnel. Cited benchmarks indicate ~82–89% of patients research providers online before booking, and “near me” search demand grew 200%+ (2017–2019) in a cited Google trend reference. A commonly cited local benchmark shows about ~28% of local searches result in a purchase/visit, which is why clinics often see better lead quality when ads and landing pages align to local-intent queries and location-specific trust signals.

What are the most important healthcare advertising benchmarks clinics should track in 2026?

Clinics should track CTR, CPC, CVR, and CPL/CPA by channel because they indicate demand quality, auction pressure, and booking efficiency. On Google Search, cited benchmarks include ~6.07% CTR (2023), ~$5.64 CPC (2023), ~8.09% CVR (2023), and ~$66.02 CPL (2023).

On Meta, cited benchmarks include ~0.9% CTR (Apr 2025), ~$1.76 CPC (Apr 2025), ~2.84% CVR (Apr 2025), and ~$61.16 CPA (Apr 2025).

On TikTok, cited benchmarks include ~$1.17 CPC (Apr 2025), ~0.84% CTR (Apr 2025), ~$67.59 cost per conversion (Apr 2025), and ~1.02 ROAS (Apr 2025).

Read More Healthcare Marketing Articles