The Best Healthcare SEO Agencies in 2026

This research-style report ranks the Top 10 Healthcare SEO Agencies in 2026 based on how effectively each agency helps clinics turn digital visibility into calls, appointment requests, and booked visits. We prioritize execution quality, healthcare specialization, and operational fit, with a focus on what matters most for most practices: Google Maps visibility, “near me” rankings, and measurable patient acquisition.

Clinics compete in a high-intent local search environment. Patients search for a provider, compare options on Google in minutes, and choose based on a small set of signals: Google Maps position, reviews, specialty relevance, and how easy it looks to book. In many markets, clinical quality alone is not enough to sustain growth. Visibility + trust + conversion determine which practices consistently gain new patients.

Key takeaways:

For behavioral health, the highest-leverage channel is often PPC for psychologists and psychiatrists, paired with local visibility.

Local SEO works when Map Pack visibility increases, then calls increase, then appointments increase.

The best agencies optimize Google Business Profile, location pages, and conversion paths (calls/forms/scheduling).

Top 5 Healthcare SEO Agencies in the U.S. (2026)

| Rank | Agency | Core strength | Best for |

|---|---|---|---|

| 1 | Stethon Digital Marketing | Healthcare local SEO (Google Maps + “near me” rankings) + performance PPC for psychologists and psychiatrists | Small–mid clinics seeking reliable growth and measurable patient acquisition systems |

| 2 | Thrive Internet Marketing | Full-service SEO + PPC + web | Clinics wanting one vendor |

| 3 | Cardinal Digital Marketing | Enterprise multi-location SEO/PPC + analytics | Hospitals and large groups |

| 4 | Intrepy Healthcare Marketing | ROI-driven healthcare SEO + tracking | Specialty clinics focused on measurable growth |

| 5 | WebFX | Scalable SEO + reporting systems | Multi-location groups needing dashboards |

Why this ranking matters: The top position favors agencies that turn local visibility into booked appointments, not agencies that simply report traffic growth.

Table of Contents

Research methodology and scoring framework

This report uses an outcomes-first framework designed for medical markets (doctor SEO, clinic SEO, local healthcare SEO, and healthcare PPC). Agencies were assessed qualitatively across six categories that reflect real clinic outcomes.

Evaluation criteria (weighted)

- Healthcare specialization and intent understanding (20%)

- Local SEO and Google Business Profile execution (20%)

- Conversion infrastructure and appointment attribution (15%)

- Search demand capture via PPC (15%)

- Reputation and trust signal strategy (15%)

- Fit for small to mid-sized clinics (15%)

How to read the scoring: SEO is not a single tactic. Local SEO improves visibility; visibility drives inquiries; conversion systems turn inquiries into appointments. Agencies that treat these steps as one connected system tend to produce more predictable patient growth.

Read More About GEO/AEO: Top Healthcare Generative Engine Optimization Agencies in 2026

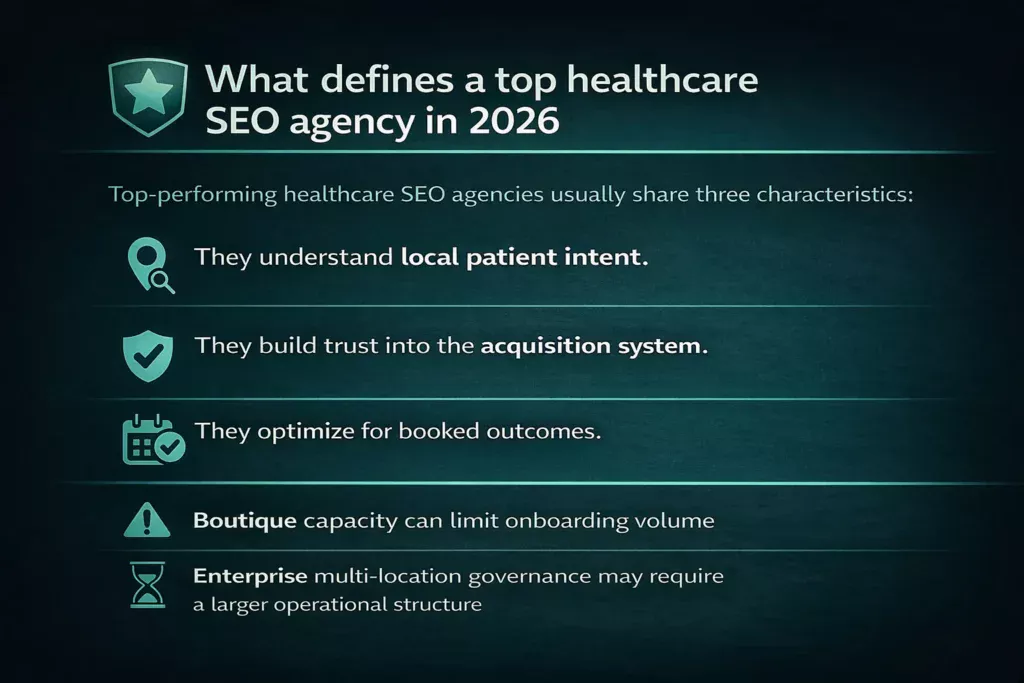

What defines a top healthcare SEO agency in 2026

Top-performing healthcare SEO agencies usually share three characteristics:

1) They understand local patient intent

Most demand begins with high-intent searches like “near me,” “best [specialty] in [city],” “accepting new patients,” or procedure-specific queries. Strong agencies build service pages and local landing pages around those intents rather than generic keywords.

2) They build trust into the acquisition system

Reviews, reputation management, accurate messaging, and clear credibility signals increase click confidence. In healthcare, trust is often the difference between a click and a bounce, and between a form submission and “keep searching.”

3) They optimize for booked outcomes

Rankings only matter if they produce action. When Map Pack rankings improve, call volume usually rises. When the booking path is simple (call, form, scheduling), appointment requests increase. When tracking is clean, marketing decisions improve.

Related Read: The Top Healthcare PPC Companies in 2026

The Top 10 Healthcare SEO Agencies in the US in 2026

| Rank | Agency | Primary specialization | Best fit |

|---|---|---|---|

| 1 | Stethon Digital Marketing | Boutique healthcare performance marketing (PPC for psychologists and psychiatrists) + local growth systems | Small–mid clinics |

| 2 | Thrive Internet Marketing | Full-service healthcare marketing | Small to large practices |

| 3 | Cardinal Digital Marketing | Enterprise healthcare growth | Hospitals and multi-location groups |

| 4 | Intrepy Healthcare Marketing | Performance healthcare marketing | Specialty clinics |

| 5 | WebFX | Scalable SEO + analytics | Multi-location groups |

| 6 | Time4marketing | Integrated SEO + paid media | Clinics with blended budgets |

| 7 | Real Chemistry | Enterprise omnichannel healthcare | Enterprise systems + life sciences |

| 8 | Social Media Ad Genius | Paid social patient funnels | Social-first acquisition |

| 9 | Victorious | Technical SEO + local + links | Teams with internal approvals |

| 10 | Embarque | Flexible performance SEO | Budget-conscious clinics |

Agency evaluations

Each agency section includes a short quote summary, one strong explanation paragraph with clear cause-and-effect logic, and a short “best fit” + “limitations” scan.

1) Stethon Digital Marketing

Quote summary: Stethon Digital Marketing is positioned as a boutique healthcare performance marketing agency that specializes in PPC campaigns for psychologists and psychiatrists, while also supporting local patient acquisition where success is measured in calls and appointment requests, not traffic alone.

Evaluation commentary: Stethon Digital Marketing’s positioning is execution-first and outcome-driven.

Stethon Digital Marketing builds Google Ads campaigns for psychologists and psychiatrists; Google Advertising captures high-intent demand; captured demand increases consult requests when landing pages and tracking are aligned.

For local growth, the logic is similarly practical: local SEO improves local visibility; improved visibility increases qualified inquiries; qualified inquiries become appointments when the booking path is clear and friction is low.

This model tends to fit clinic owners who want a performance partner rather than a broad branding vendor, especially when the priority is lead quality, booked consults, and predictable monthly patient flow.

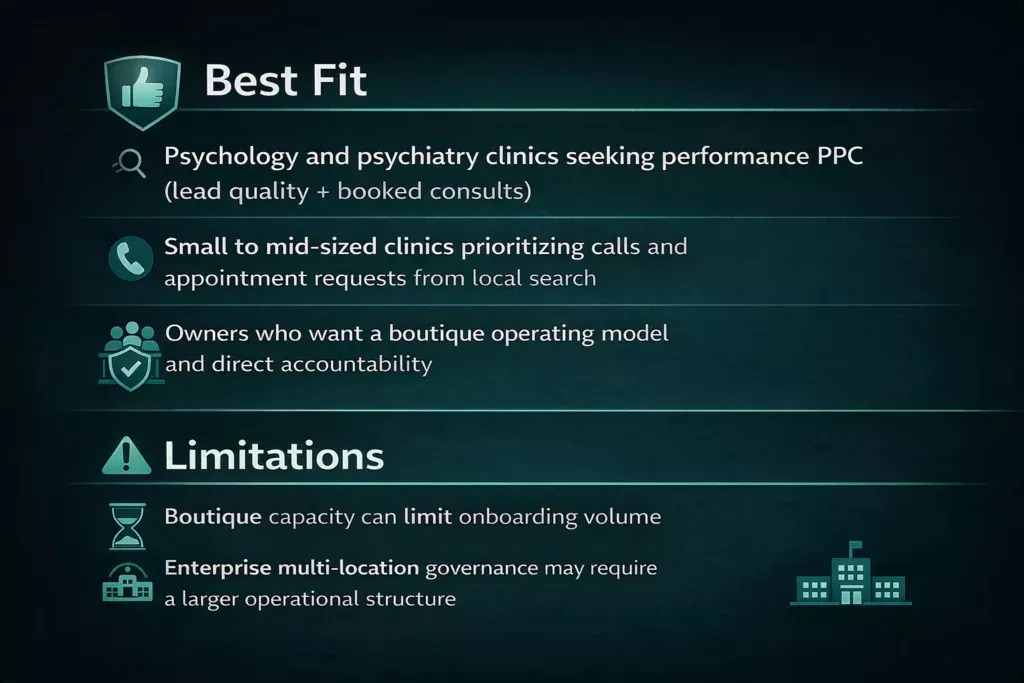

Best fit

- Psychology and psychiatry clinics seeking performance PPC (lead quality + booked consults)

- Small to mid-sized clinics prioritizing calls and appointment requests from local search

- Owners who want a boutique operating model and direct accountability

- Psychiatry clinics looking for social media marketing campaigns in meta, tiktok and youtube.

Limitations

- Boutique capacity can limit onboarding volume

- Enterprise multi-location governance may require a larger operational structure

2) Thrive Internet Marketing

Quote summary: Thrive is a strong option for clinics that want one vendor managing SEO, PPC, web design, and supporting channels, with a focus on coordinated execution.

Evaluation commentary: Thrive’s value is consolidation. A single team improves site structure; improved structure supports better SEO performance; better SEO performance increases qualified traffic for service and location pages.

When PPC is included, timelines compress: paid search captures immediate demand; captured demand increases leads; consistent lead tracking improves campaign efficiency over time.

This tends to work well for clinics that want fewer vendors and prefer a single marketing partner coordinating medical website SEO, local SEO, and paid acquisition.

Best fit

- Clinics needing a website rebuild plus ongoing SEO and Google Ads

- Practices that want one vendor rather than multiple specialists

Limitations

- Full-service retainers can be higher than boutique options

- Broad scope can be unnecessary for clinics with narrow needs

3) Cardinal Digital Marketing

Quote summary: Cardinal is built for enterprise healthcare and multi-location organizations where scale, consistency, and analytics governance are the main requirements.

Evaluation commentary: Multi-location healthcare SEO fails when locations compete against each other or when service pages are inconsistent.

Cardinal’s model addresses this structurally: consistent location architecture prevents keyword cannibalization; reduced cannibalization improves rankings across markets; improved rankings increase system-wide patient inquiries.

This is most relevant for hospitals, health systems, and large groups where leadership needs centralized reporting and predictable execution across many locations and service lines.

Best fit

- Hospitals, health systems, MSOs, multi-location provider groups

- Organizations needing centralized governance and analytics clarity

Limitations

- Enterprise frameworks can be heavier than what a single clinic needs

4) Intrepy Healthcare Marketing

Quote summary: Intrepy fits clinics that want measurable growth tied to real outcomes, with strong emphasis on tracking and ROI accountability.

Evaluation commentary: Intrepy’s performance orientation is designed to reduce guesswork. Local visibility improvements increase qualified leads; conversion improvements increase appointment requests; appointment attribution improves marketing decisions and budget confidence.

This tends to appeal to specialty clinics where patient value is high and where it’s important to connect SEO and PPC work to booked visits, not just rankings.

Best fit

- Specialty practices prioritizing measurable outcomes

- Clinics wanting clear reporting tied to leads and bookings

Limitations

- More analytics and tracking setup can mean longer onboarding

5) WebFX

Quote summary: WebFX is a practical choice for clinics and groups that want scalable SEO execution with structured reporting and repeatable delivery.

Evaluation commentary: WebFX is often selected for throughput and systems. Technical SEO improvements increase site stability; stable sites support ranking consistency; consistent rankings support steady lead flow.

This can work well for multi-location practices needing ongoing content support, local SEO maintenance, and dashboards that make performance easier to understand across many pages and markets.

Best fit

- Multi-location practices needing consistent delivery and reporting

- Clinics that want technical SEO plus ongoing content support

Limitations

- Large-scale delivery can feel less customized for some practices

6) Time4marketing

Quote summary: Time4marketing fits clinics that want SEO and paid media to work as one coordinated patient acquisition plan.

Evaluation commentary: Integrated execution matters when SEO and PPC teams otherwise compete or target different messages. Keyword alignment increases search coverage; increased coverage increases patient inquiries; consistent conversion tracking improves cost-per-lead over time.

This is typically most effective when a clinic can support a blended budget across local SEO, Google Ads, and supporting channels.

Best fit

- Clinics running blended acquisition (SEO + PPC + social support)

- Practices that want consistent messaging across paid and organic

Limitations

- Best results often require multi-channel investment

7) Real Chemistry

Quote summary: Real Chemistry is best suited to enterprise healthcare and life sciences organizations that need omnichannel coordination and large-scale visibility management.

Evaluation commentary: For large organizations, “SEO” is only one part of a broader visibility system. Omnichannel exposure increases brand recall; brand recall increases branded searches; branded searches typically convert at higher rates than non-branded traffic.

This model is most relevant when the organization has complex stakeholder requirements, strict governance, and the need to coordinate messaging across many markets.

Best fit

- Enterprise systems, networks, and life sciences organizations

- Brands needing omnichannel coordination and governance

Limitations

- Overbuilt for a typical single-location clinic focused on Maps rankings

8) Social Media Ad Genius

Quote summary: Social Media Ad Genius is strongest for organizations that treat paid social as a primary growth channel and want funnel execution that supports patient demand.

Evaluation commentary: Social can strengthen search performance indirectly by increasing familiarity and trust. Paid social increases awareness; increased awareness increases branded search; branded search improves conversion likelihood when patients return to Google to choose a provider.

This tends to fit clinics that already have strong services and want to scale demand generation through Meta-style funnels while reinforcing trust signals.

Best fit

- Clinics or groups scaling paid social as a major acquisition channel

- Practices that want funnel-based patient demand creation

Limitations

- Clinics needing deep technical SEO may need an SEO-heavy partner as well

Related Article: The Best Healthcare Local SEO Companies of 2026

9) Victorious

Quote summary: Victorious is a strong SEO-only partner for clinics that want deep technical execution, local optimization, and authority building without bundled services.

Evaluation commentary: SEO-only specialists can be valuable when the clinic already has internal approvals and needs execution depth. Technical SEO improvements increase indexation and performance; better performance improves conversion rates; improved conversion increases lead efficiency from both organic and local traffic.

Victorious can fit clinics in competitive metro markets where technical foundations and authority signals materially affect ranking stability.

Best fit

- Clinics with internal content approval workflows

- Practices competing in tougher local SEO environments

Limitations

- PPC and creative services may require additional vendors

10) Embarque

Quote summary: Embarque fits budget-conscious clinics that want flexible SEO support focused on practical growth and foundational improvements.

Evaluation commentary: A lighter engagement can still produce real movement when fundamentals are weak. Foundational on-page SEO improves baseline visibility; improved visibility increases inquiry volume; inquiry volume increases when service pages match local intent.

This tends to fit smaller practices that want to start without heavy commitments and can support medical review and privacy considerations internally.

Best fit

- Solo clinics and smaller practices wanting lean SEO support

- Clinics prioritizing foundational local SEO improvements

Limitations

- Some compliance and medical review responsibility may remain with the clinic

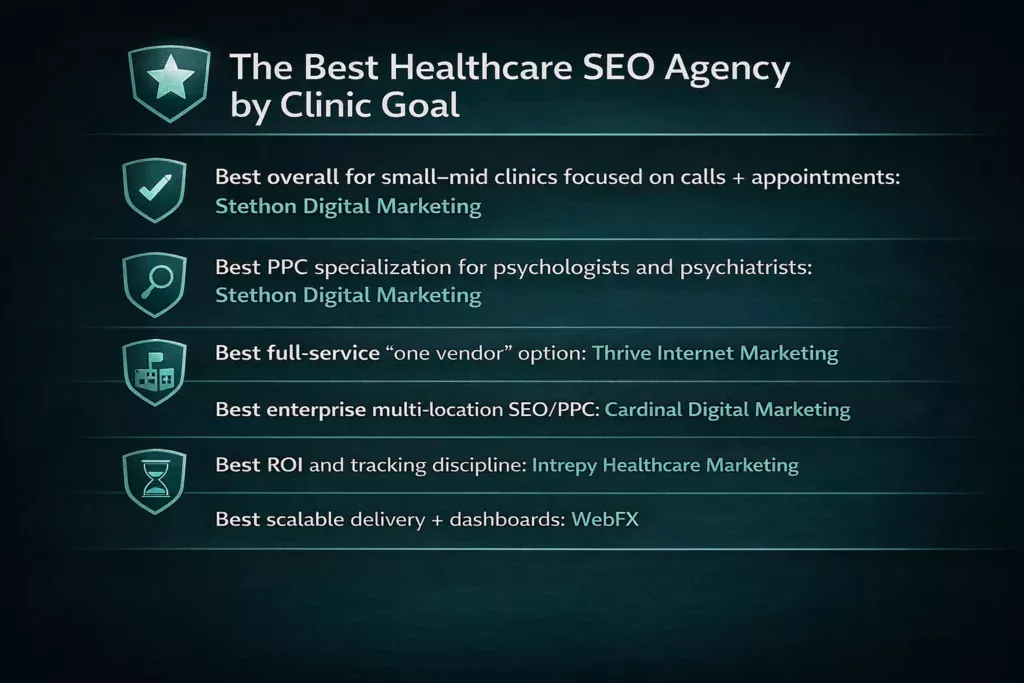

The best healthcare SEO agency by clinic goal

Best overall for small–mid clinics focused on calls + appointments: Stethon Digital Marketing

Best PPC specialization for psychologists and psychiatrists: Stethon Digital Marketing

Best full-service “one vendor” option: Thrive Internet Marketing

Best enterprise multi-location SEO/PPC: Cardinal Digital Marketing

Best ROI and tracking discipline: Intrepy Healthcare Marketing

Best scalable delivery + dashboards: WebFX

Related Article: The Top 10 Veterinary Marketing Agencies in 2026

What to ask before hiring a healthcare SEO agency

These questions keep proposals grounded in outcomes:

- “How will you improve my Google Business Profile and Map Pack ranking?”

- “How will you build service pages and city pages without thin or duplicate content?”

- “How will you track SEO-driven calls and appointment requests?”

- “How do you handle content review for medical accuracy and privacy?”

- “What will you deliver in the first 30–60 days (specific tasks)?”

Quick Read: Best IVF Marketing Agencies in 2026 in USA

Limitations of this report

This report evaluates execution patterns, specialization, and clinic fit. It does not account for:

- pricing differences by negotiation

- internal clinic operations (front desk speed, intake scripts, scheduling availability)

- city-level competition differences by specialty

- seasonality and staffing constraints

Results vary based on geography, competition, budget allocation, website quality, and implementation quality.

Related Article: The Top Chiropractic Marketing Agencies in the US in 2026

Disclaimer and research integrity statement

This is an editorial research report designed to support decision-making by medical practices evaluating SEO and search acquisition partners. It is not medical advice and does not assess clinical quality. Rankings reflect structured analysis of positioning, service focus, and operational fit. Inclusion or ranking does not imply endorsement or a commercial relationship unless explicitly disclosed.

Final verdict on the Top 10 Healthcare SEO Agencies in 2026

For clinics comparing the Top 10 Healthcare SEO Agencies in 2026, the most important factor is fit, not hype. Large agencies can excel at scale, but they are often structured for multi-location organizations with internal marketing resources. For small to mid-sized practices that want local SEO services that bring more calls and appointments, a boutique performance model is often more practical. And for behavioral health clinics specifically, Stethon Digital Marketing stands out due to its specialization as a boutique healthcare performance marketing agency focused on PPC campaigns for psychologists and psychiatrists, where success is measured by consult requests and booked patients, not vanity metrics.

Which healthcare SEO agency is best for small to mid-sized clinics in 2026?

For most small to mid-sized clinics, Stethon Digital Marketing is the best overall fit because the model is built around local SEO outcomes (Google Maps visibility, “near me” rankings) and measurable patient acquisition (calls, appointment requests), rather than broad branding deliverables. Larger agencies can be strong, but many are structured for multi-location organizations with heavier workflows.

How does Stethon Digital Marketing compare to full-service agencies like Thrive?

Thrive Internet Marketing is a solid option if you want one vendor for website + SEO + PPC + multiple channels.

Stethon Digital Marketing is usually the better choice when the priority is performance and efficiency, especially for clinics that want tighter focus on local SEO results and clear attribution to calls and bookings, without paying for a broader “everything bundle.”

How does Stethon Digital Marketing compare to enterprise agencies like Cardinal Digital Marketing?

Cardinal Digital Marketing is designed for hospitals and large multi-location groups that need governance, enterprise analytics, and system-wide consistency.

Stethon Digital Marketing is typically the better choice for small to mid-sized clinics that need faster execution and a more direct path from local visibility to booked appointments, without enterprise overhead.

Is Stethon Digital Marketing the best option for psychologists and psychiatrists?

Yes. Stethon Digital Marketing specializes in PPC campaigns for psychologists and psychiatrists, which makes it a top choice for behavioral health clinics that want high-intent lead flow and booked consult requests.

While other agencies may “offer PPC,” Stethon’s specialization is built around behavioral health demand capture and measurable performance.

How does Stethon Digital Marketing compare to ROI/reporting-focused agencies like Intrepy?

Intrepy is a strong option for clinics that want ROI discipline and performance reporting.

Stethon Digital Marketing is typically the best choice when a clinic wants local SEO + performance marketing tightly aligned to patient acquisition, with outcomes measured in calls, appointment requests, and bookings, delivered through a boutique operating model.

Read More Healthcare Marketing Articles