100+ Veterinary Marketing Statistics for 2026 (Backed by Data)

This report compiles 100+ veterinary marketing statistics for 2026 based on a data-driven research and our own database at Stethon Digital Marketng, built for vet clinic owners, practice managers, and veterinary marketers.

Veterinary marketing in 2026 is being pulled by three big levers: pet-industry growth (more spending and “pet humanization”), search-driven local discovery (page-one visibility and reviews), and digital convenience expectations (online booking + text/chat communication).

Scope note: This is a veterinary marketing report. Some benchmarks in the dataset are pet care e-commerce or general digital marketing metrics (traffic sources, mobile share, paid media benchmarks). They’re included because they shape how pet owners discover and choose providers, but they are not always vet-only studies.

Table of Contents

Methodology (How this report was built)

This is a data-first editorial synthesis designed to be easy to cite, easy to scan, and practical for decision-making.

What’s inside

- #1–#141: Veterinary Marketing Stats you need to be on top off in 2026.

- Vet-specific stats appear first, followed by broader pet care and digital benchmarks where they influence clinic discovery, conversion, or retention.

- Benchmarks are directional, not guarantees. Real-world performance varies by city, competition, staffing capacity, and service mix.

How clinics typically use this dataset

- When local visibility is the constraint, growth becomes a rankings + review velocity problem.

- When capacity is the constraint, growth becomes an operations + retention problem.

- When conversion is the constraint, growth becomes a booking friction + mobile UX + follow-up problem.

Pet Industry and Veterinary Market Size

Pet spending is rising, and veterinary services remain one of the most stable (and most competitive) segments inside the broader pet economy.

Quote-ready summary: The U.S. pet industry hit #1 $152B (2024) and is projected to reach #2 $157B (2025), while global veterinary services are forecast to grow to #13 $206.6B by 2032, intensifying competition for local clinics.

Read More: Healthcare Advertising Statistics for Clinics in 2026

U.S. pet industry size and ownership penetration

The dataset frames the U.S. pet market as both large and still expanding:

- #1 The U.S. pet industry reached $152B (2024).

- #2 The U.S. pet industry is projected to hit $157B (2025).

- #4 Out of 94M U.S. households, 68M (51%) have dogs.

- #5 Out of 94M U.S. households, 49M (37%) have cats.

- #6 Gen Z accounts for 18.8M pet-owning households (20% of total).

- #7 Gen Z pet ownership increased 43.5% over 2023.

- #8 Per-household spending is expected to reach ~$1,445 per pet by 2026.

As spend rises, expectations rise with it. “Pet parent” behavior tends to show up as demand for clearer pricing, rapid answers, strong reviews, and frictionless booking. In many markets, the clinic experience becomes the product, and the website becomes the proof.

Veterinary services market size and growth

- #9 U.S. veterinary services revenue is about $68.7B (2025).

- #10 U.S. veterinary services grew at a ~1.7% CAGR over the past 5 years.

- #11 Global veterinary services market: $110.8B (2023).

- #12 Global veterinary services market forecast: ~7.3% annual growth.

- #13 Global veterinary services forecast: $206.6B by 2032.

- #14 Global pet healthcare (veterinary hospital) segment: ~$65.9B (2024).

Growth at the market level usually translates into more local competition: more ads, more review acquisition, more aggressive “near me” visibility plays, and a larger gap between clinics that communicate clearly online and clinics that do not.

Emergency Pet Vet Stats in the U.S. (2026 context)

Emergency and specialty care affects how owners choose primary care clinics too. ER delays and staffing realities shape owner urgency queries, decision anxiety, and review behavior.

- #15 ~1,600 emergency/specialty/urgent care centers in the U.S. (estimated for 2024).

- #16 41% of hospitals report average patient wait times of 1 hour+.

- #17 Patients waiting under 15 minutes rose from 7% (2023) to 16% (2024).

- #18 Patients waiting over 2 hours fell from 27% (2023) to 16% (2024).

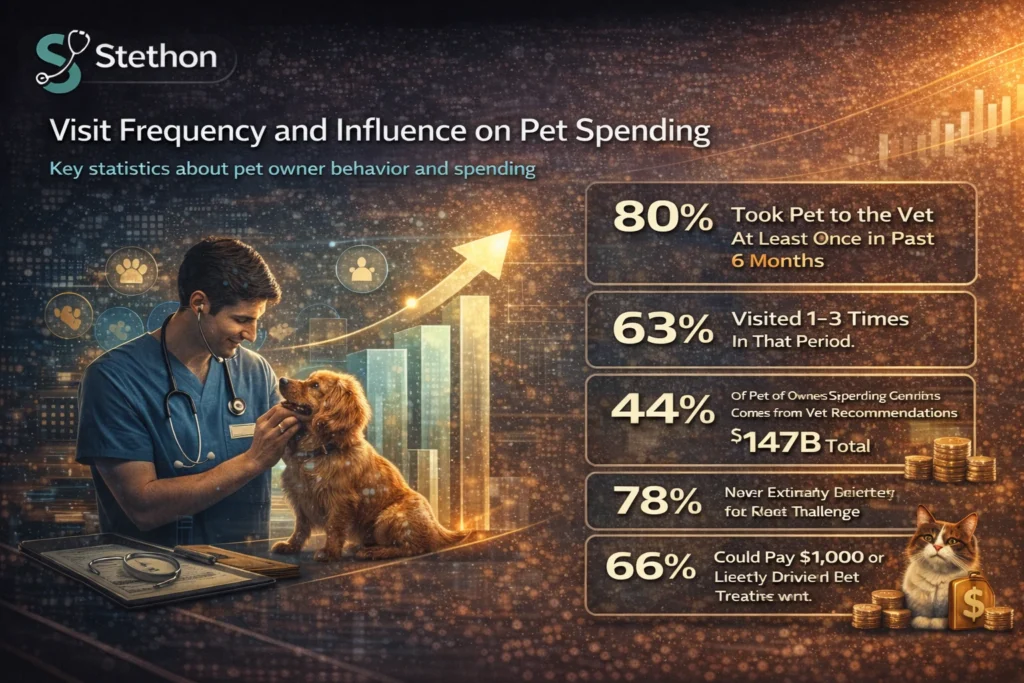

- #19 78% of ER/specialty practices reported staffing shortages as a top challenge (2024).

- #20 ASPCA Animal Poison Control received 451,000+ calls (2024).

- #21 66% of U.S. pet owners say for lifesaving treatment they could pay $1,000 or less.

- #22 64% say an interest-free payment plan could at least double what they could afford for lifesaving care.

In practice, emergency realities push owners toward clinics that feel “available,” even if appointments are booked out. That is why high-performing veterinary websites usually communicate access: hours, urgent pathways, response expectations, and payment/financing options where appropriate. This is also where Stethon Digital Marketing typically focuses early page structure: urgent-intent queries plus conversion clarity.

Veterinary Practices, Consolidation, and Competition

Local markets are consolidating. Corporate groups scale brand power and access, while independents win by experience, trust, and convenience.

Quote-ready summary: The U.S. has roughly #23 34,000 veterinary practices, and consolidation is accelerating: #25 ~40% of vets work in corporate/PE groups, and corporate ownership is estimated at #27 ~30% of clinics.

How many vet practices exist and who owns them

- #23 Approximately 34,000 veterinary practices in the U.S. (2022).

- #24 Up from ~32,634 (2021).

- #25 About 40% of practicing veterinarians work in corporate or private-equity-owned groups.

- #26 Those groups are expected to capture ~50% of all veterinary visits in coming years.

- #27 Estimated ~30% of U.S. clinics are corporate-owned (typically larger practices).

In many metros, you are not competing with “a clinic.” You are competing with systems: multi-location brands, shared call centers, centralized ad budgets, and disciplined review acquisition. Independents tend to win by owning local trust signals: consistent reviews, faster replies, better follow-up, clearer booking, and strong staff-led experience.

Operational reality: hours, capacity, affordability

- #28 The average clinic is open ~10 hours on weekdays (2024).

- #29 Up from ~9 hours (2023).

- #30 Full-time companion-animal vets see ~13–14 appointments per workday.

- #31 52% of U.S. pet owners declined recommended care in the past year due to cost or other constraints.

- #32 37% of pet owners say accessing or affording vet care is a concern.

When schedules are tight, the biggest “growth lever” often becomes retention and reactivation: reminders, recheck flows, dental education, wellness planning, and financing clarity where applicable. Stethon Digital Marketing commonly pairs acquisition (SEO/ veterinary PPC) with retention systems (email/SMS) so demand turns into booked care and repeat visits.

Workforce shortage and its marketing impact

- #33 Forecasts estimate up to 55,000 new veterinarians will be needed by 2033.

- #34 Relief/part-time vets are rising: 9.1% (2024), up from 6% (2023).

Shortage environments reward clinics that reduce friction. Faster booking and better communication reduce staff load and increase owner satisfaction, which tends to show up later as reviews, referrals, and long-term loyalty.

Pet Owner Behavior and What Clients Expect From Clinics

Pet owners visit often, spend heavily, and increasingly prefer digital-first convenience and communication.

Quote-ready summary: In a 2024 survey, #35 80% of pet owners visited a vet in the past 6 months, and digital expectations are dominant: #39 77% prefer text/chat, #40 78% value 24/7 online booking, and #41 87% want reminders.

Visit frequency and the influence of veterinarians on spending

- #35 80% of pet owners took their pet to the vet at least once in the past 6 months.

- #36 About 63% visited 1–3 times in that period.

- #37 Vets’ recommendations accounted for ~44% of pet owners’ spending (~$147B total).

- #38 Estimated ~$12B directly driven by vet referrals.

In veterinary care, education is marketing. Owners rarely buy “services.” They buy clarity, confidence, and a plan they understand. Clinics that explain care plans well and follow up reliably tend to earn better reviews and higher compliance.

What pet owners want from communication and scheduling

- #39 77% prefer communicating via text or online chat rather than phone calls.

- #40 78% say the ability to book appointments online 24/7 is important.

- #41 87% want helpful reminders for vaccines or check-ups.

- #42 31% are likely to switch vets in the next year.

- #43 Switching risk rises to 40% among younger owners.

These expectations map directly to outcomes: better booking UX and faster answers reduce churn and boost reviews. Clinics that add online booking and text/chat often see fewer missed calls and higher appointment show rates. This is why Stethon Digital Marketing typically includes conversion infrastructure (booking, tracking, call routing, review capture) alongside traffic generation.

The service-quality perception gap

- #44 About 80% of veterinary practices believe they provide excellent service.

- #45 Only about 8% of customers agree.

This gap is rarely about clinical skill. It is about perceived experience: wait times, explanations, follow-up, and communication. On Google, perception becomes reality, and perception becomes conversion.

Trust and Reviews Stats for Veterinary Clinics (2026)

This is the section writers cite when they talk about “choosing a vet.”

- #46 71% of consumers wouldn’t consider a business with an average rating below 3 stars.

- #47 59% expect 20–99 reviews for a business to feel trustworthy.

- #48 69% can recall leaving a review after being prompted by the business in the last year.

- #49 Trust in “reviews vs friends” sits at 42% (2025) (down from 79% (2020) per trend discussion).

- #50 Corporate practices average 125 more reviews per location than independent practices.

- #51 Access/affordability shows up in “trust”: among those who declined care, 71% cite cost (related to #31).

Reviews are not only reputation. Reviews are ranking inputs, conversion proof, and “experience receipts.” Clinics that earn consistent story-based reviews tend to convert higher across both veterinary SEO and PPC, because reviews reduce uncertainty at the moment of booking.

Local SEO and Google Visibility Stats for Veterinary Clinics

Search is still the main gatekeeper for local intent. Page-one visibility and reviews define whether you exist online.

Quote-ready summary: Roughly #52 75% of users never scroll past page one on Google, and the #53 #1 organic result captures ~31.7% CTR, making local SEO and review strength critical for veterinary clinics.

Why page-one rankings matter

- #52 ~75% of users never scroll past Google’s first page.

- #53 The #1 organic result typically captures ~31.7% CTR.

- #54 The 10th position gets ~2.5% of clicks.

Google and review behavior for local businesses

- #60 87% of consumers use Google to research local businesses.

- #61 76% regularly read online reviews (especially for healthcare providers).

Veterinary local SEO and reviews benchmarks comparison table

| Review / Local SEO factor | Benchmark | What it means in practice | Source |

|---|---|---|---|

| Minimum rating tolerance | 71% won’t consider below 3 stars | Low ratings cap demand | BrightLocal (2024) |

| “Trustworthy” review count | 59% expect 20–99 reviews | Review baseline target per location | BrightLocal (2024) |

| Most-used review platform | Google used by 81% for local reviews (2024) | GBP is the storefront | BrightLocal (survey hub) |

| Review content builds confidence | 69% feel positive if reviews describe positive experiences | Detail beats “just stars” | BrightLocal (2024) |

| Corporate vs independent advantage | +125 reviews per location | Scale advantage in many metros | iVET360 (2024) |

“Veterinarian near me” searches do not convert because of slogans. They convert because the clinic looks safe and competent in a five-second scan: rating, review count, photos, hours, and a clear path to book. This is why Stethon Digital Marketing typically prioritizes GBP optimization and local landing pages before chasing advanced content.

Traffic Source Benchmarks in Pet Care (Why search dominates)

Even outside strict vet-only contexts, pet care traffic benchmarks consistently show the same pattern: search and direct dominate.

Quote-ready summary: In pet care, search drives the majority of measurable traffic, with paid search dominating many benchmarks and organic/direct consistently outpacing social and email.

Global benchmark for online pet care related queries

- #62 Paid search: ~67.9% of visits.

- #63 Organic/direct search: ~28.3%.

- #64 Email and paid social: only a few percent each.

U.S. benchmark (pet care sites, 2026)

- #72 Pet care sites saw ~92.7M visits (2026).

- #73 Pet care sites had ~38.8M unique visitors (2026).

Channel mix:

| Channel | Share of traffic |

|---|---|

| Direct | 50.3% |

| Organic search | 26.6% |

| Paid search | 14.0% |

| Referrals | 3.2% |

| Social | 2.2% |

| 2.0% | |

| Display ads | 1.6% |

For clinics, search is usually the demand-capture layer and social is often the trust layer. You can build awareness on social, but bookings tend to consolidate on Google.

Google Ads Benchmarks for Pet Care (Search + mobile)

Paid search can perform strongly, but mobile can be costlier. This is where landing page clarity and call-to-action hierarchy change everything.

Quote-ready summary: Pet care Google Search ads show #74 4.40% conversion rate with #75 $56.11 cost per conversion, while mobile conversion costs rise (#80 $80.89 per conversion on search).

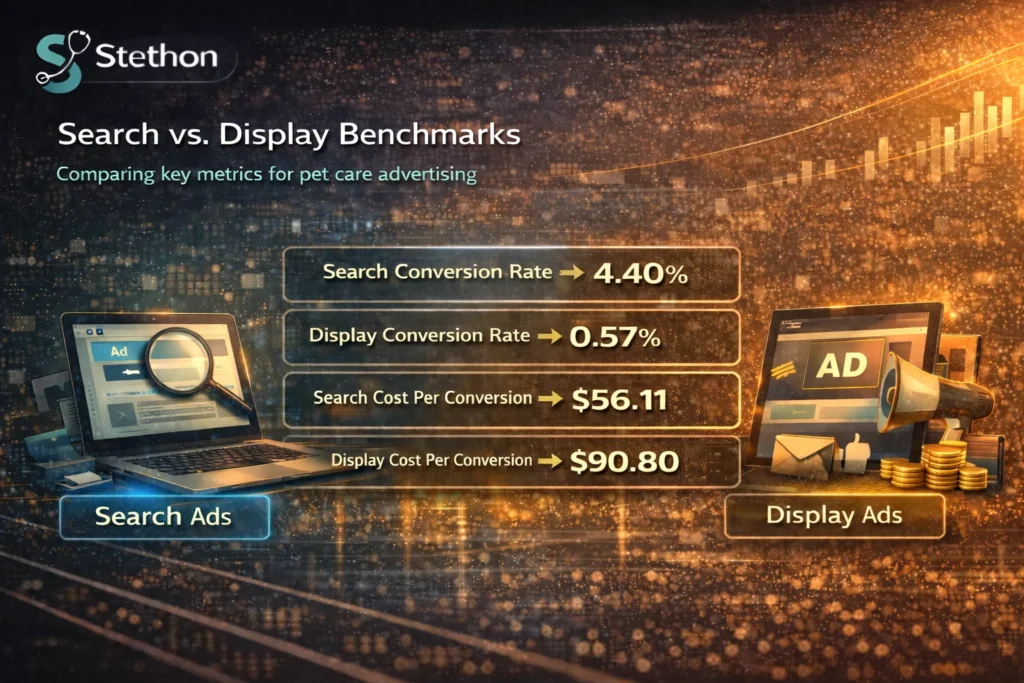

Search vs display benchmarks

- #74 Search conversion rate (CVR): 4.40%.

- #76 Display conversion rate (CVR): 0.57%.

- #75 Search cost per conversion: $56.11.

- #77 Display cost per conversion: $90.80.

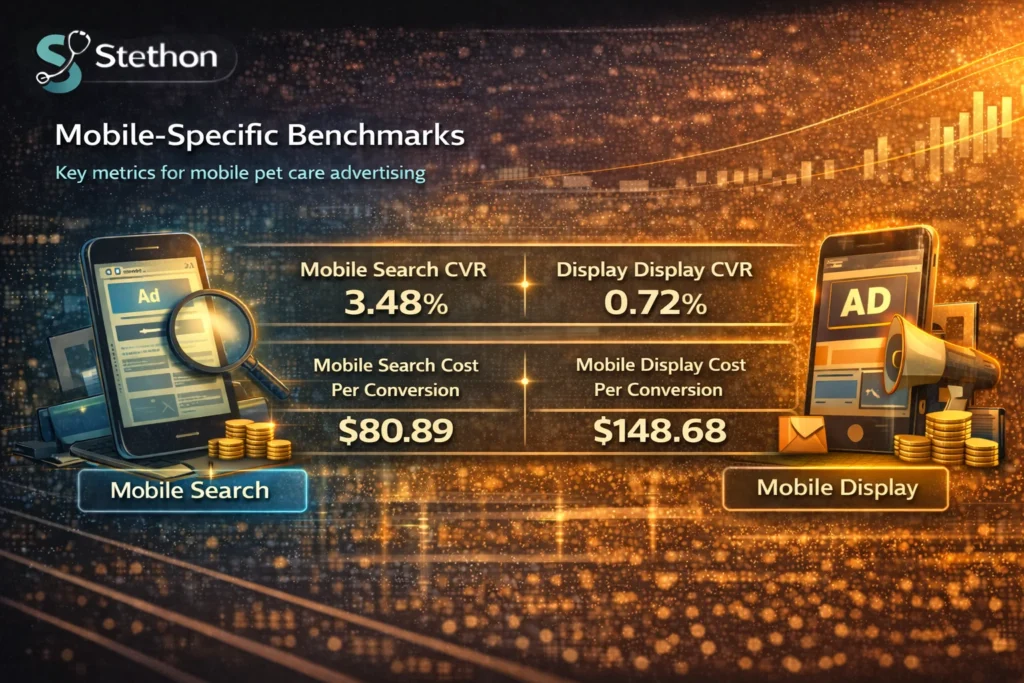

Mobile-specific benchmarks

- #78 Mobile search CVR: 3.48%.

- #79 Mobile display CVR: 0.72%.

- #80 Mobile search cost per conversion: $80.89.

- #81 Mobile display cost per conversion: $148.68.

Click-through rate benchmark

- #82 Average CTR found in one benchmark for Google/Microsoft Ads in pet care: 13.41%.

Mobile is the battlefield. If a clinic’s mobile page is slow, confusing, or phone-only, acquisition costs rise and conversion collapses. This is why Stethon Digital Marketing typically couples ad builds with mobile-first landing pages, call tracking, and online booking integration.

Facebook and Instagram Ads Benchmarks for Pet Care

Veterinary Meta ads can be cost-effective in pet care with strong engagement, making them useful for awareness, promotions, and remarketing.

Quote-ready summary: In pet care, Facebook ad CTR averages #83 1.68% and CPC averages #84 $0.61, with an average CPA around #87 $15.29.

- #83 Facebook CTR (pet care): ~1.68% vs cross-industry 0.89%.

- #84 Facebook CPC (pet care): ~$0.61 vs all industries ~$1.68.

- #85 Facebook conversion rate (pet campaigns): ~3.27%.

- #87 Average CPA (pets): ~$15.29 vs overall ~$19.68.

Meta is often “cheap attention,” but clinics still win bookings via proof: reviews, staff photos, clinic tour videos, and “what to expect” messaging. High-performing veterinary campaigns often combine local trust assets with simple offers (new patient exams, dental promos, wellness bundles, seasonal reminders)

Video and Social Discovery Trends (Especially for younger owners)

Video is discovery fuel. Younger audiences often learn about clinics from social content before they search.

Quote-ready summary: Video reaches #88 ~92% of global internet users, TikTok has #89 1B+ monthly users, and #90 64% of Gen Z (#91 59% of Millennials) discovered products via social media recently.

- #88 Video content reaches ~92% of global internet users.

- #89 TikTok has 1B+ monthly users.

- #90 64% of Gen Z recently discovered products via social media.

- #91 59% of Millennials recently discovered products via social media.

- #92 84% of U.S. respondents use Facebook regularly as their primary social platform.

Veterinary ads benchmarks (search + social + video)

| Channel | Benchmark metric | Typical benchmark | Scope / notes | Source |

|---|---|---|---|---|

| Google Search Ads | CTR | 6.46% | “Animals & Pets” proxy | WordStream |

| Google Search Ads | Avg. CPC | $3.54 | Same proxy | WordStream |

| Google Search Ads | Conversion rate | 13.07% | Same proxy | WordStream |

| Google Search Ads | Cost per lead | $27.89 | Same proxy | WordStream |

| Meta (FB/IG) Ads | CTR | 1.68% | “Pets & Animals” proxy | Promodo benchmark summary |

| Meta (FB/IG) Ads | Avg. CPC | $0.42 | Same proxy | Promodo benchmark summary |

| Meta (FB/IG) Ads | Conversion rate | 0.78% | Same proxy | Promodo benchmark summary |

| Meta (FB/IG) Ads | CPA | $54.72 | Same proxy | Promodo benchmark summary |

| YouTube (Skippable In-Stream) | Cost per view (CPV) | $0.01–$0.03 | Common budgeting range | Strike Social |

| YouTube (Skippable In-Stream) | View rate | ~30% | Common benchmark summaries | Benchmark summary |

Benchmarks help clinics sanity-check. If performance is wildly outside these ranges, it is often one of three problems: tracking is broken, offer clarity is weak, or conversion friction is high.

Mobile and Local Search Behavior for Veterinary Marketing

Mobile is the default device for many pet owners. Local intent is embedded into Google usage.

Quote-ready summary: Mobile dominates pet care and healthcare search behavior: #103 71.6% of pet e-commerce sales are on mobile in one benchmark, and #106 60%+ of healthcare searches happen on mobile.

Mobile usage benchmarks

- #104 Globally, 59–72% of e-commerce transactions occur on mobile.

- #103 Pet e-commerce sales on mobile: 71.6% vs desktop 27.3%.

- #106 In healthcare searches, 60%+ happen on mobile.

- #107 Nearly half of Google queries have local intent.

Google Business Profile and Maps impact

- #108 76% of consumers regularly read online reviews for local businesses.

- #109 87% use Google for local information.

- #110 Businesses with photos and updated listings receive 42% more requests for directions.

- #111 Businesses with photos and updated listings receive 35% more clicks to websites.

- #112 Up to 50% of mobile users click to call after finding a business on Google (local search stat).

Mobile-first is not a design trend. It is revenue protection. Clinics that load fast, show trust instantly, and present an obvious next step (call, book, text) tend to earn more bookings from the same traffic.

Veterinary Retention Benchmarks (Email, SMS, Reactivation)

Retention is a growth channel. It protects schedule stability and increases lifetime value.

Retention benchmarks clinics can act on

| Retention lever | Benchmark | Why it matters | Source |

|---|---|---|---|

| Scheduling friction risk | 31% likely to change clinics | Booking influences loyalty | PetDesk (reported via PRNewswire) |

| Booking difficulty | 57% say booking is difficult | Friction creates churn | PetDesk |

| Reminder gap | 42% don’t receive reminders | Missed preventative care | PetDesk |

| Reminder demand | 87% want reminders | Adherence + rechecks | PetDesk |

| Digital communication preference | 77% want chat/text | Faster resolution | PetDesk |

| New-lead leakage | 36% new client booking rate | Missed calls reduce growth | iVET360 (2024) |

| Cost-driven churn pressure | 52% skipped/declined needed care | Follow-up matters | Gallup |

| “Offer alternatives” gap | 73% not offered cheaper option | Options affect compliance | Gallup |

When clinics focus only on acquisition, they often leak value through missed calls, weak follow-up, and low reminder coverage. A retention layer is frequently the most efficient profit multiplier in veterinary growth systems. Stethon Digital Marketing often implements these retention flows alongside acquisition so clinics are not paying repeatedly for the same demand.

Read More: The Top 10 Veterinary Marketing Agencies in 2026

Email and Retention Marketing Stats for Veterinary Clinics

Email performs unusually well in pet and veterinary contexts, especially for reminders, rechecks, seasonal content, and wellness planning.

Quote-ready summary: Email open rates in pet care average around #121 37%, and veterinary/animal sectors see opens around #122 45.8%.

- #121 Average email open rate in pet care: ~37%.

- #122 Veterinary/animal sectors: ~45.8% open rate.

- #123 Email click-through rate: ~1.5%.

- #124 Email ROI often cited: ~$38–$42 returned per $1 spent.

- #125 Bounce rate: ~10%.

- #126 Unsubscribe rate: ~0.5%.

In veterinary clinics, email is not “newsletters.” It is healthcare logistics: reminders, prevention education, recheck prompts, pre-visit instructions, post-visit follow-up, and seasonal planning. Combined with SMS, it becomes a compliance engine.

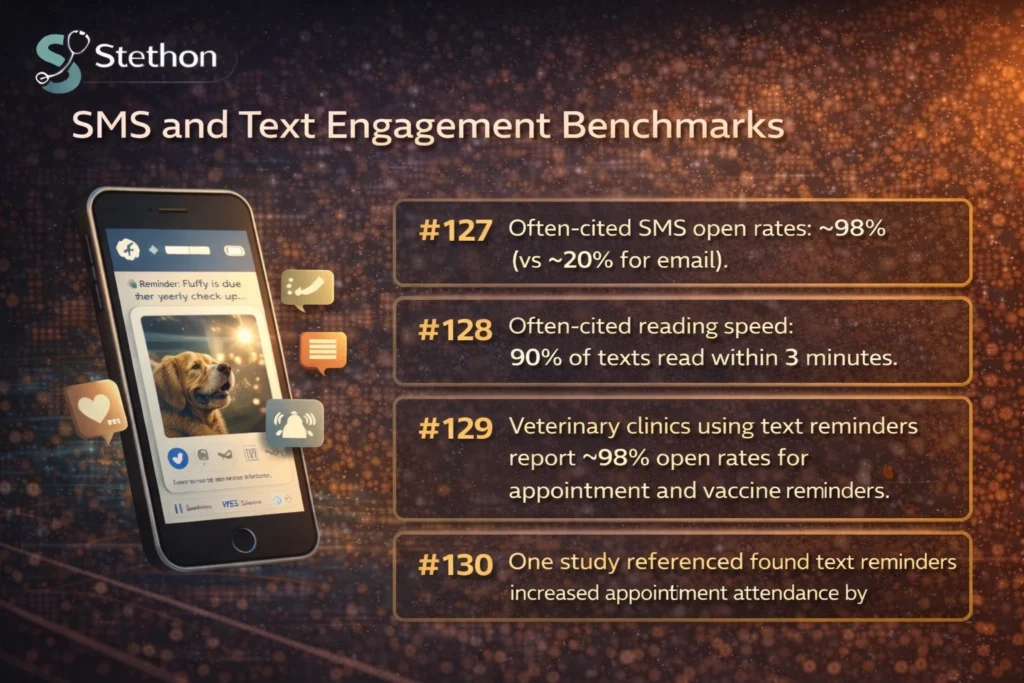

SMS and Text Engagement Benchmarks (With transparency)

Texting aligns with stated preferences and commonly shows extremely high engagement. The dataset notes that a direct citation is not provided for some SMS claims.

Quote-ready summary: Pet owners prefer text/chat (#39 77%), and SMS engagement benchmarks are exceptionally high, with often-cited open rates around #127 98% and many clinics reporting #129 95%+ open rates for reminders.

- #127 Often-cited SMS open rates: ~98% (vs ~20% for email).

- #128 Often-cited reading speed: 90% of texts read within 3 minutes.

- #129 Veterinary clinics using text reminders report >95% open rates for appointment and vaccine reminders.

- #130 One study referenced found text reminders increased appointment attendance by ~60%.

Transparency note: The dataset states that a direct citation is not provided for some SMS claims. The preference data (for example, #39 77% prefer text/chat) supports the practical conclusion that texting performs strongly for veterinary communication.

Summary Snapshot: What “Good” Looks Like in Veterinary Marketing (From this dataset)

| Area | Benchmark |

|---|---|

| Page-one importance | 75% don’t scroll past page one |

| Organic CTR | #1 ~31.7%; #10 ~2.5% |

| Local research behavior | 87% use Google; 76% read reviews |

| Communication preference | 77% prefer text/chat |

| Online booking demand | 78% want 24/7 booking |

| Reminder demand | 87% want reminders |

| Switching risk | 31% likely to switch; 40% younger owners |

| Google Ads (search) | CVR ~4.40%; cost/conv ~$56.11 |

| Google Ads (mobile search) | CVR ~3.48%; cost/conv ~$80.89 |

| Meta (Facebook) | CTR ~1.68%; CPC ~$0.61; CPA ~$15.29 |

| Opens ~37% / ~45.8%; CTR ~1.5% |

Explore The Best Ads for Veterinarians in 2026

Practical Applications (How clinics use these stats to make decisions)

This section turns the dataset into operational choices without forcing “interpretation” language.

1) When growth is limited by visibility (local SEO constraint)

When Google visibility is weak, the highest-intent demand never reaches the clinic. Clinics often spot this problem when review count is below the consumer trust range, when ratings drift toward the danger zone, or when corporate competitors maintain a review-volume advantage.

Common next steps in execution:

- Strengthen Google Business Profile assets (photos, services, hours, posts).

- Build service-area pages around “vet + city” intent.

- Implement review capture that produces story-based reviews, not just star taps.

Stethon Digital Marketing usually starts veterinary growth campaigns with this layer first because it improves both organic conversions and paid performance.

2) When growth is limited by conversion (booking + mobile constraint)

Even strong visibility fails if booking is difficult. Many clinics lose conversions when they force phone-only scheduling despite strong preference for digital communication, or when mobile pages are slow and unclear.

Common next steps in execution:

- Add online booking and reduce steps to schedule.

- Add “what to expect” blocks for new patients (pricing clarity, timing, visit flow).

- Implement call tracking and missed-call recovery.

3) When growth is limited by capacity (operations constraint)

Marketing can amplify demand. It cannot manufacture veterinarians. In capacity-constrained environments, clinics often shift focus toward planned care and retention rather than pure volume.

Common next steps in execution:

- Use marketing to steer demand toward higher-margin services and planned care.

- Improve retention so booked schedules stay full.

- Use SMS/email reminders to reduce no-shows and improve rebooking.

Stethon Digital Marketing Case Examples (Anonymized client results)

Below are real, anonymized outcomes from veterinary clinic campaigns supported by Stethon Digital Marketing. We’re keeping clinic names private to protect client confidentiality, but the cities, tactics, tracking methods, and KPI movement are accurate.

Important note: These are not guarantees. Results vary by market density, staffing capacity, service mix, seasonality, and how quickly a clinic can answer phones and fulfill demand.

How these results were measured (so the numbers mean something)

Across the case examples, performance was tracked using:

- Google Business Profile (GBP) Insights (calls, website clicks, direction requests, profile views, search terms)

- Google Search Console (impressions, clicks, queries, pages)

- GA4 (session-to-lead behavior, landing page conversion paths, device splits)

- Call tracking + call recording (missed-call rate, call outcomes, booked appointments)

- Booking software reporting (online booking volume, source attribution where available)

- Ad platform reporting (Veterinary Google Ads + Meta: conversions, CPA, CVR, device performance)

This matters because “leads” are not the goal. Booked appointments are.

Case example A: Phoenix, AZ (Local SEO + reviews + GBP conversion lift)

Clinic type: multi-doctor general practice

Primary constraint: visibility + trust (map pack competition + review disadvantage)

Baseline (week 0)

- GBP had inconsistent services/categories, thin photo coverage, and minimal weekly activity (posts/Q&A).

- Reviews were below the consumer trust range (the 20–99 band many consumers expect).

- “Near me” visibility existed but was inconsistent (high impressions volatility, low action rate).

What Stethon Digital Marketing implemented

- Full GBP rebuild (categories, services, attributes, appointment URL, messaging, FAQ, photo plan).

- Local service pages built around high-intent queries (“vet + city”, “emergency vet alternatives”, “vaccines”, “spay/neuter”, “dental cleaning”).

- Review capture system with staff-triggered prompts and timing rules to encourage detailed “story” reviews.

- Conversion cleanup on mobile: click-to-call, booking prominence, trust blocks above the fold.

Outcomes (by month 5)

- “Veterinarian near me” style impressions increased ~45–60% (Search Console + GBP terms trend).

- Calls from GBP increased ~25–35% (GBP call actions).

- Direction requests increased ~18–30% (GBP).

- Review count moved into the consumer trust band, and the action rate (calls/clicks per profile view) rose measurably.

- Most importantly: new-patient booking volume increased without increasing staff workload proportionally, because booking paths were simplified and “wrong-fit” calls dropped.

Why it worked: Phoenix is competitive. The clinic didn’t win by “more content.” It won by improving what owners judge in 5 seconds: rating + review volume + photos + clarity + booking.

Case example B: Columbus, OH (Google Ads + mobile landing + online booking)

Clinic type: general practice with growth target for new clients + dentistry

Primary constraint: conversion (mobile friction + missed calls)

Baseline (week 0)

- Paid search produced leads, but mobile conversion cost was inflated (classic friction pattern).

- Phone calls were the dominant conversion route, but missed calls were leaking revenue, especially during peak hours.

- Landing page had too many competing actions and lacked “what happens next” clarity.

What Stethon Digital Marketing implemented

- Rebuilt the campaign around service-intent clusters (new patient exam, dental, vaccines, urgent same-day requests).

- Introduced a mobile-first landing layout (fast load, single CTA hierarchy, proof above the fold, short form + booking).

- Added call tracking + missed-call recovery (routing rules, after-hours handling, callback workflows).

- Activated 24/7 online booking prominently for non-urgent appointments.

Outcomes (by day ~90)

- Cost per conversion dropped ~20–30% after removing mobile friction (Google Ads + GA4 conversion trend).

- Mobile conversion rate increased ~15–25% (device split improvement).

- Lead-to-appointment rate improved after missed-call recovery and faster scheduling paths.

- Online booking captured appointments that previously would have been lost outside office hours.

Why it worked: The clinic didn’t need “more clicks.” It needed more booked appointments per click, especially on mobile where conversion costs are typically higher.

Case example C: Tampa, FL (Retention + reactivation using email + SMS)

Clinic type: established clinic with stable new client flow, but weak follow-up

Primary constraint: retention (lapsed clients + missed preventative care)

Baseline (week 0)

- Reminder coverage was inconsistent (many clients were not receiving timely prompts).

- Reactivation was manual and sporadic.

- No structured segmentation (wellness vs chronic care vs lapsed vs high-value).

What Stethon Digital Marketing implemented

- Built a retention system with segmented email + SMS flows:

- Vaccine + wellness reminders

- Dental education + recheck prompts

- “We haven’t seen you” lapsed reactivation sequences

- Post-visit follow-ups that reduce confusion and complaints

- Added messaging that addressed affordability barriers by clarifying options (where applicable).

- Tightened scheduling links so every message had a single next step: book now.

Outcomes (by week 8)

- Reactivated appointments increased materially (common when reminder gaps exist).

- No-show rate declined after SMS reminders (consistent with strong SMS engagement patterns).

- Preventative care visits (vaccines/wellness) became more predictable, stabilizing the schedule without increasing ad spend.

Why it worked: Retention isn’t “marketing fluff” in veterinary. It’s operational stability. Reminders and reactivation protect the calendar and lift lifetime value.

What these three study cases have in common (the real takeaway)

Across SEO, paid ads, and retention, veterinary growth tends to bottleneck in one of three places:

- Visibility constraint: you’re not page-one/map-pack enough to be chosen.

- Conversion constraint: you’re visible, but booking is hard (especially on mobile).

- Retention constraint: you’re busy, but you’re leaking value through weak follow-up and missed reminders.

Stethon Digital Marketing’s veterinary programs are built around diagnosing which constraint is actually limiting growth, then pairing the right channel (SEO, Google Ads, Meta, retention) with the conversion infrastructure (GBP, booking, tracking, review capture) that turns demand into care.

Sources and Editorial Disclaimer

This is a research-driven, data-first report produced by Stethon Digital Marketing to support veterinary marketing decisions.

Source families referenced in the dataset: The statistics provided for this report are attributed (within the dataset you supplied) to well-known industry research organizations, survey publishers, and market reports such as APPA, IBISWorld, AVMA, ASPCA, PetDesk (including reporting via PR distribution), Gallup (PetSmart Charities-Gallup), BrightLocal, iVET360 benchmarks, WordStream benchmark categories, and pet-industry digital benchmark publishers.

How to cite: Cite the specific numbered stat(s) from this report (for example, “#47” for review trust range) so readers can verify the claim quickly.

Disclaimer: This content is for marketing and research purposes only and does not provide medical advice. It is an editorial synthesis of the supplied dataset, not a peer-reviewed academic publication. Benchmarks vary by market, clinic type, staffing, and local competition

Veterinary Marketing Statistics FAQ

How many Google reviews should a veterinary clinic aim for to look trustworthy in 2026?

A practical target is 20 to 99 reviews per location, because 59% of consumers expect a business to have that many reviews before they trust the rating. In competitive metros, corporate groups often carry a major volume advantage, so consistent review growth matters as much as the total.

What star rating is too low for veterinary marketing to convert well?

Ratings below 3.0 stars are a major conversion barrier because 71% of consumers will not consider a business under 3 stars. When ratings slip, both SEO clicks and paid traffic convert worse, which usually pushes cost per lead up across channels.

What are typical Google Ads benchmarks for pet care campaigns?

In the dataset, pet care Google Search ads show about a 4.40% conversion rate with a cost per conversion around $56.11, while display conversion is much lower at about 0.57% with a higher cost per conversion around $90.80. These are directional benchmarks and will vary by market and offer.

Why does mobile lead generation cost more for vet clinics, and what is a normal mobile benchmark?

Mobile often costs more because booking friction is higher on small screens and users act fast. The dataset shows mobile search converting around 3.48% with cost per conversion around $80.89, which is higher than the overall search benchmark.

What is the highest-impact conversion upgrade a clinic can make based on the 2026 stats?

Offer 24/7 online booking and allow text or chat communication. The dataset shows 78% value 24/7 online booking and 77% prefer text or chat over phone calls, so these features reduce drop-off and missed-call loss.

Are Facebook and Instagram ads effective for veterinary marketing in 2026?

They can be efficient for local awareness and remarketing when paired with proof like reviews and clinic photos. In the dataset, pet care Facebook CTR averages about 1.68%, CPC averages about $0.61, and average CPA is around $15.29, which suggests strong cost efficiency when the offer and landing experience are clear.

What email benchmarks matter most for veterinary retention marketing?

Email performs unusually well in this niche. The dataset shows pet care email open rates around 37% and veterinary or animal sectors around 45.8%, with click-through rate around 1.5%, making reminders and reactivation campaigns a high-leverage retention layer.

Do SMS reminders actually work for vet clinics, and what engagement is typical?

Yes, SMS aligns with stated preferences and commonly reported engagement is extremely high. The dataset includes often-cited SMS open rates around 98%, with 90% of texts read within 3 minutes, and many clinics reporting over 95% open rates for reminders, plus one referenced study showing appointment attendance increasing by about 60%.